Blockchain Technology

In 2008, Blockchain Technology was first presented and was executed from 2009. The first execution was with cryptocurrency, Bitcoin. The achievement of Blockchain has moved the technology to an extensive range which eventually provided a considerable measure of comfort to large organizations.

Importance of Blockchain Technology

The blockchain technology is a strategy that leads everybody to the highest level of accountability. With the assistance of this technology, exchanges cannot be missed, human or machine mistakes will be limited. Moreover, these days, real banks are testing this technology as they can utilize it for cash transfers, record keeping, and other backend functions.

Blockchain technology is exceptionally secure due to the reason every person who goes into the Blockchain system is given a unique identity which is connected to the user’s account. This guarantees the owner that he is handling the account, working on the exchanges. The block encryption in the chain makes it harder for any hacker to upset the traditional arrangement of the chain.

Before the development of the Blockchain, the general financial procedure takes around three days to settle, yet after the presentation of Blockchain, the time decreased to about minutes or merely even seconds.

Advantages of Blockchain

Since Blockchain is an open-source record, every single exchange will be made open, and thus there will be no possibility of fraud occurring. The virtue of the blockchain framework will always be observed by miners who watch out for a wide range of exchanges nonstop.

- Zero Government Interference

Government or any financial institution has zero control on virtual monetary forms that depend on the blockchain technology. Thus there will be no intruding by the governments.

The digital currencies or Virtual currencies that depend on Blockchain offer exchange times that are ten times quicker than the standard bank timings. Furthermore, blockchain exchanges will be generally completed in a couple of minutes.

- Enhances Financial Efficiency

The blockchain technology gives people and organizations a chance to make exchanges straightforwardly to the end client without including any intermediaries. This increases the financial productivity in each country and lets individuals be less dependent on banks or financial institutions. Hence it will save a great deal of cash for individuals with regards to fees yet, besides, other related expenses using banks.

Because of the security reasons, the blockchain program was made so that any block or even an exchange that adds to the chain cannot be altered, which gives a high scope of security.

Disadvantages of Blockchain

The utilization of power in the Blockchain is relatively high as in a specific year, the power utilization of Bitcoin miners was more than the per capita power consumption of 159 individual nations. Keeping a real-time ledger is one of the reasons for this utilization because each time it creates another new node; it transmits with every single other node simultaneously.

According to research, the average price of a Bitcoin exchange is $75 to $160, and the more significant part of this cost is covered by power consumption. There are exceptionally fewer possibilities that the development of technology can resolve this issue. Another factor is the storage issues may be included, and power issues cannot be settled.

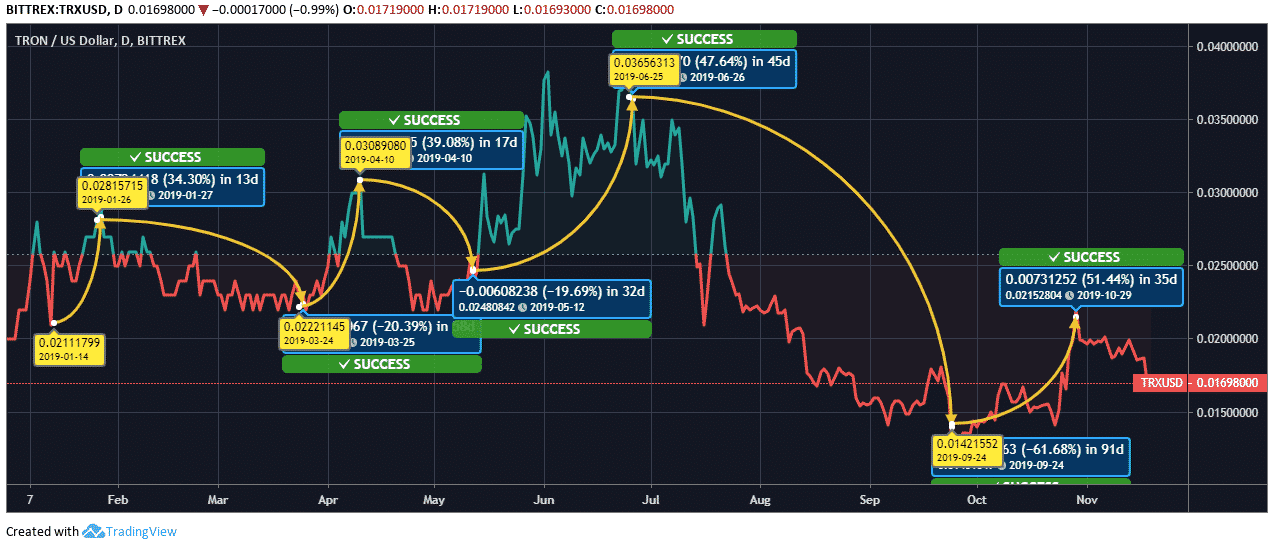

The virtual currencies that depend on blockchain technology are exceptionally exposed to high volatility. One good example is the fluctuating costs of Bitcoin that change every day. One reason behind the instability is that both the decentralized blockchain technology and the virtual currencies are very new to the market.

The Blockchain is not as straightforward as it would appear; nontechnology or old age individuals will not be able to understand this technology quickly. Nodes, Cryptography, Mining these terms by one way or another understandable to a certain degree, yet it is beyond imagination to expect to have a trustworthy service without knowing it fully.

Bitcoin Blockchain is 170 GB yet consistently when new exchanges happen, information is recorded to Blockchain, so Blockchain expands each second. The second famous cryptocurrency Ethereum blockchain size is more than 1 TB that is the reason why substantial public executions of Blockchain are uncertain.

Wrap up

Some accept that Blockchain will help in making cryptocurrencies, which will end up being a potential rival to valuable metals while others agree that it might be a disillusion. In any case, blockchain technology is one of the incredibly imaginative creations that technology has ever observed.