1) IG

In 2021 ranking, this ultimate forex broker has bagged the top spot for Platforms & Tools and Research and scored 99 out of 99 trust scores. It is a low-risk forex broker.

Best known for:

IG has earned the #1 spot in many sectors. They are:

- Offering investments with its more than 17K tradeable instruments

- Commissions & Fees

- Education

- Mobile Trading

- Professional Trading and

- Cryptocurrency Trading

Founded in 1974, this forex broker has used its size to offer cutting-edge prices to its traders. The mini and standard size contracts, the minimum spreads on the EUR/USD is 0.6 pips, and IG offers 0.75 pips for the average spreads.

For active traders who are qualified as per EU rules and regulations, IG offers highly competitive prices on the Forex Direct. Its details are:

Account Minimum and fee:

On IG’s L2 Dealer platform, the active traders need to maintain a minimum of 1000 GBP.

Also, the traders get to take benefits of the tiered pricing scale. This scale is usually dependent on the previous month’s trading volume of the trader.

Further, IG behaves like an agency broker when it comes to Forex Direct streams from interbank fluidity. There IG does not charge any additional spread, but it adds a commission to every trade.

Pros and Cons of IG:

IG is a leading trading platform, but like with anything else great comes its shortcomings too. Here are the pros and cons of IG at a glance:

| Pros | Cons |

|

|

|

|

|

|

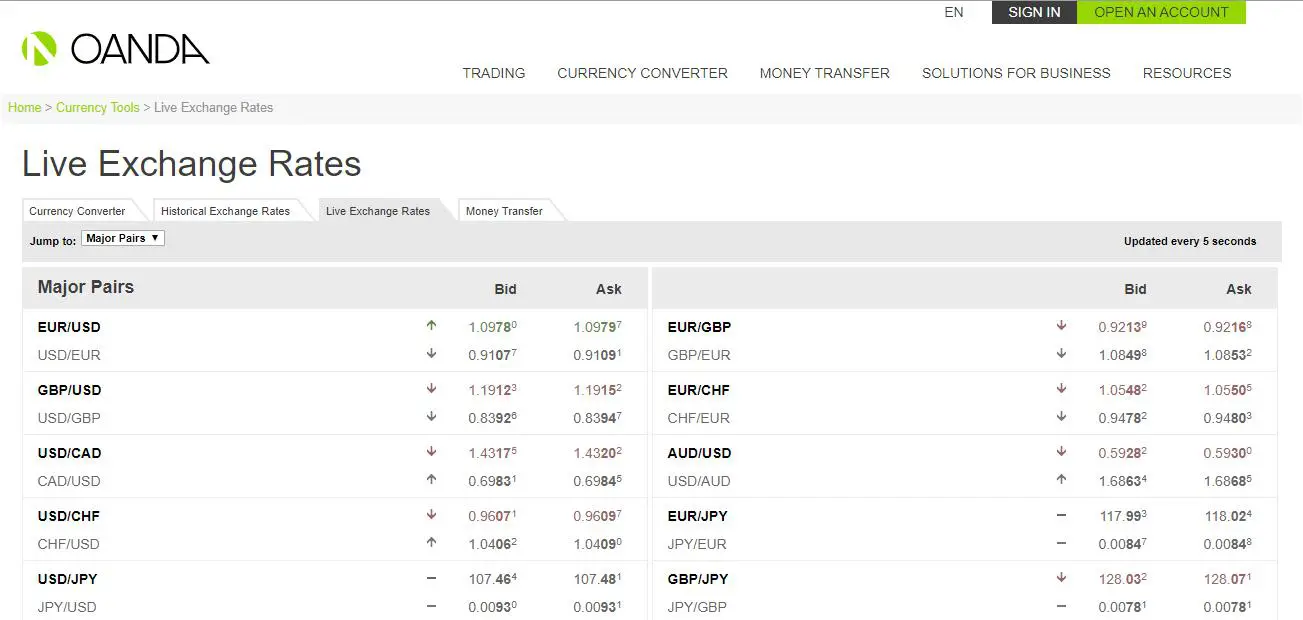

2) Oanda

This American forex broker is a world-renowned platform that was founded back in 1996. Oanda has earned the trust of its users due to its long-standing proven-track record of excellence, and transparent financial disclosures.

It is regulated by the following top-tier authorities:

- The US Retail Foreign Exchange Dealer (RFED)

- The UK’s Financial Conduct Authority (FCA)

Oanda is best known for:

As per 2021 reports, Oanda is best known for being the best mobile trading platform and best broker for the API trading platform.

Account minimum and fee:

Using Oanda comes with low fees overall with a few reasonable exception. Oanda is a very user-friendly online trading platform that offers easy account opening processes.

- Minimum account fee: Oanda does not charge any account fees from its users.

- Minimum deposit fee: Oanda does not charge any deposit fees from its users.

- Minimum withdrawal fee: Oanda does not charge any withdrawal fees from its users.

- Minimum inactivity fee: There is a minimum inactivity fee. It is 10 U.S. Dollars and it is charged after two years of inactivity.

The Pros and Cons of using Oanda:

Oanda is a very user-friendly and powerful online trading platform. It offers its users a plethora of technical indicators and great API options. However, along with perks, it has some areas to improve too. So, have a quick glance at the pros and cons of using Oanda:

| Pros | Cons |

|

|

|

|

|

|

3) Forex.com

Forex.com is a baby company of GAIN Capital Holdings. It is a highly (multiple-countries) regulated platform that caters to both the new traders as well as the professionals. It offers a range of accounts, transparent pricing, and average spreads for all types of accounts. It is a relatively new platform that was founded in 2011. It is regulated in:

- United Kingdom

- United States

- Canada

- Australia

- Japan

- Singapore

- The Cayman Islands

Minimum account and fee:

Forex.com offers a standard account and a Direct Market Access (DMA) account to its traders. Forex.com also offers a commission account that offers lesser spreads, and lower commissions in comparison to the DMA account. Here is its fee structure:

- Active Trader Program: This program can be used by opening an account with a minimum of 25,000 U.S. Dollars or 25 U.S. Dollars trade per month.

- Inactivity fees: Any account that stays inactive for over 12 months and has less than 10,000 U.S. Dollars, an inactivity fee of 15 U.S. Dollars is charged per month.

- Minimum deposit fee: Forex.com does not charge any deposit fees from its users.

- Minimum withdrawal fee: Forex.com does not charge any withdrawal fees from its users.

- U.S. wire transfer fees: Transfers that are lower than 10,000 U.S. Dollars are subjected to 25 U.S. Dollars fee, and others are subjected to 40 U.S. Dollars.

Pros and Cons of using Forex.com:

| Pros | Cons |

|

|

|

|

|

|

4) Saxo Bank

This Danish investment bank has earned a great reputation in offering online trading and investments to its clients across the world. Saxo Bank is regulated across multiple international authorities and top-tier financial authorities, which include:

- Danish Financial Services Agency (FSA) and

- The UK Financial Conduct Authority (FCA)

Best known for:

Saxo Bank has earned the top spot in the following sectors as per the latest 2021 reports:

- Best forex broker

- Best web trading platform

- Best broker for research

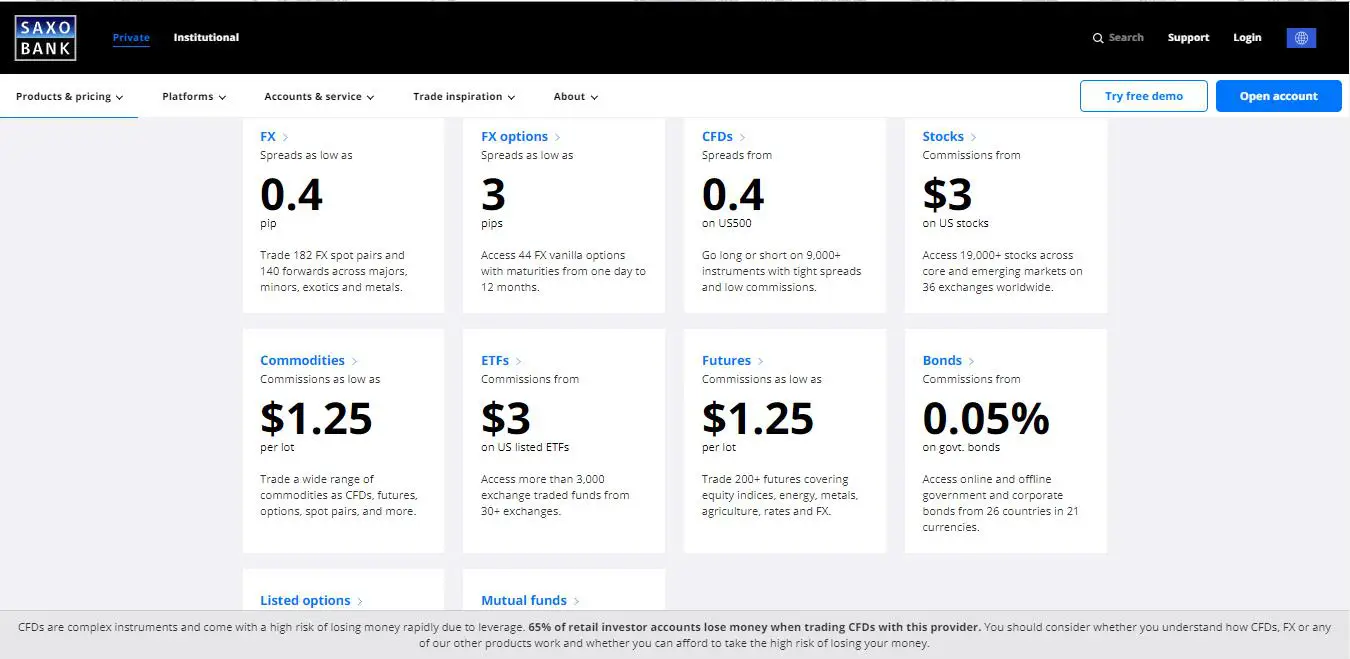

Minimum account and fee:

Saxo offers an average trading fee class. The fees at Saxo are built into the spread. The Average spread cost is 0.6 pip. This can be further reduced to 0.4 pips with the help of using the VIP pricing at Saxo.

- Minimum withdrawal fee: Saxo does not charge any withdrawal fees from its users.

- The minimum deposit at Saxo: The minimum deposit for Saxo traders is 600 U.S. Dollars.

- Inactivity fees at Saxo: After one quarter, in the UK, the inactivity fee at Saxo is 25 GBP. The SIPP and ISA accounts are not subjected to this fee. For countries outside of the UK, the inactivity fee is 100 U.S. Dollars post six months of inactivity.

Pros and Cons of using Forex.com:

Saxo offers superb online trading services, a versatile product portfolio, and is active in coming up with new trade ideas to support its users. But it has its own downsides too. Here is a glimpse of the pros and cons of Saxo Banks:

| Pros | Cons |

|

|

|

|

|

|

5) FXCM

FXCM stands for Forex Capital Market. This UK-based broker was founded in 1999. It offers forex and CFDs to its traders. It has earned the trust of its users through its long-standing and excellent market performance.

It is regulated by the following top-tier financial authorities:

- The UK FCA

- The Australian ASIC

Minimum account and fee:

The overall trading fees at FXCM is quite low. For a standard account, the minimum deposit at FXCM is 50 U.S. Dollars. For active trader accounts, the minimum deposit is 25,000 U.S. Dollars. Other fee-related details are:

- Minimum withdrawal fee: FXCM does not charge any withdrawal fee.

- Minimum deposit: The user of this platform has to have a minimum deposit of 50 U.S. Dollars. The deposit can be made via credit cards, electronic wallets.

- Inactivity fees at FXCM: The trader at FXCM has to pay 50 U.S. Dollars after one year of inactivity.

FXCM pros and cons:

This UK-based broker offers a quick and user-friendly account opening process. Along with great trading tools and services, FXCM also has areas where it can improve its service.

| Pros | Cons |

|

|

|

|

|

|

|

6) City Index

City Index is best known for offering:

- A wide variety of products

- Multi-asset trading

- Cutting-edge spreads

- Variety of platform options

- Fantastic research tools

- Excellent customer service

City Index is a safe and low-risk platform which is owned by GAIN Capital. It is regulated by three tier-1 jurisdictions. It offers forex and CFDs trading.

Minimum account and fee:

City Index offers cutting-edge spreads on CDs, forex, as well as spread-betting products. It offers the best fixed and variable spread pricing options. The active traders and the VIP traders can avail special discounts too at City Index. Here are the details for the advanced trader and the meta trader:

- Meta Trader: City Index offers higher spreads. The average spreads on EUR/USD is 1.7 pips. There are no price tolerance settings for the MT4 platform.

- Advanced Trader: As per last year’s reports, the average spreads on EUR/USD is 0.8 pips.

Other details about the fee-structure are as follows:

- Minimum deposit: The user of this platform has to have a minimum deposit of 50 U.S. Dollars.

The pros and cons:

This UK-based broker offers a quick and user-friendly account opening process.

Along with great trading tools and services, FXCM also has areas where it can improve its service.

| Pros | Cons |

|

|

|

|

|

|

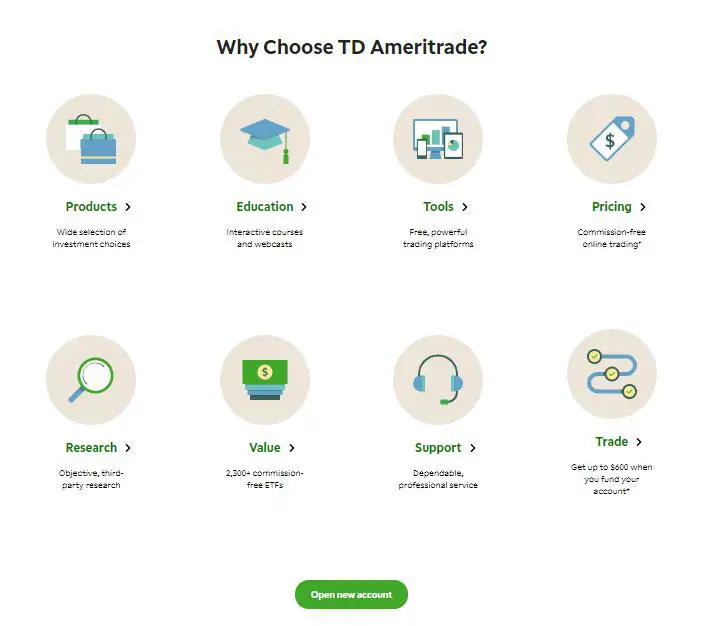

7) TD Ameritrade

This broker is the United States’ most prominent stockbroker. It was established back in 1987. It offers a variety of products to trade from, which include- Stock, ETF, Forex, Fund, Bond, Options, and Futures. It is a safe platform and is regulated by the following top-tier regulators:

- The Securities and Exchange Commission (SEC)

- Financial Industry Regulatory Authority (FINRA)

- The Commodity Futures Trading Commission (CFTC)

Best known for:

As per the latest 2021 reports, TD Ameritrade is best known for:

- Best desktop trading platform

- Best broker for options

Minimum account and fee:

The overall trading fee class is low at TD Ameritrade. Here is a glimpse of the variety of chargeable and non-chargeable fee structure:

- Minimum withdrawal fee: TD Ameritrade does not charge any withdrawal fee.

- Minimum deposit: The minimum deposit at TD Ameritrade is ZERO U.S. Dollars.

- Inactivity fees at FXCM: TD Ameritrade does not charge an inactivity fee from its traders, which is unique in comparison to its competitors in the market.

Pros and Cons of using TD Ameritrade:

TD Ameritrade charges very low trading fees and offers a great desktop trading platform. On the other hand, the platform also has its own limitations and downsides. Have a glimpse of all the pros and cons through the following table:

| Pros | Cons |

|

|

|

|

|

|

8) Interactive Brokers

Interactive Brokers is the largest U.S-based discount brokers. It was established back in 1978. It is regulated by many top-tier international financial authorities which include:

- UK’s Financial Conduct Authority (FCA)

- The US Securities and Exchange Commission (SEC)

Being regulated by many international financial authorities, the broker platform is considered safe and reliable.

Best known for:

As per 2021 market reports, Interactive Brokers is best known for:

- Best online broker

- Best broker for day trading

- Best broker for futures

Minimum account and fee:

The trading fee class at Interactive Brokers is quite low. Here are the details of fee and minimum account requirements based on different categories:

- Minimum withdrawal fee: Interactive Brokers does not charge any withdrawal fee.

- Minimum deposit: There is no minimum deposit required to have an account at this platform.

- Inactivity fees: There is no inactivity fee for US clients who select the IBKR Lite plan.

- On generating less than $10 commission: Interactive Brokers charges 10 U.S. Dollars per month when a trader doe not generates a minimum of 10 U.S. Dollars in commissions.

Pros and Cons of using Interactive Brokers:

Interactive Brokers offers a robust range of markets and products, global market regulations, and research tools. On the downside, it has its own unique points. To give you a quick full picture, here is the pros and cons table:

| Pros | Cons |

|

|

|

|

|

|

9) eToro

The Israel-based fintech start-up- eToro was established in 2007. It offers trading in the stock, ETF, forex, CFD, and cryptocurrency. This social trading broker serves uniquely. It is as follows:

- For UK clients: eToro works through entity regulated by the Financial Conduct Authority (FCA)

- For Australian clients: eToro serves the Australian Australian Securities and Investment Commission (ASIC)

- Rest of the customers: eToro serves the rest of the customers through a Cypriot entity that is regulated by the Cyprus Securities and Exchange Commission (CySEC).

Best Known for:

Despite not being listed on any stock exchange, non-annual report disclosure, or any presence of any parent bank, eToro is still considered safe because of the top-tier regulated arms in the UK and Australia. It is best known for:

- Best broker for cryptos

- Best broker for social trading

Minimum account and fee:

The trading fee class at eToro is quite low. EU users get to enjoy free stock and ETF trading. In this section, we will give you a quick run-through the account minimum and the fee structure at eToro:

- Minimum withdrawal fee: eToro charges five U.S Dollars as a withdrawal fee amount.

- Minimum deposit: The user of eToro needs to have a minimum deposit of 200 U.S. Dollars. The deposit can be made via credit card, or by any electronic wallet.

- Inactivity fees: eToro charges an inactivity fee of ten U.S. dollars monthly after one year of inactivity by the user.

eToro pros and cons:

There are bright sides as well as downsides to eToro. On the one hand, where it is famous for offering commission-free stock and ETF trading, user-friendly services, on the other hand, it has a few flaws which can be improved.

| Pros | Cons |

|

|

|

|

|

|

10) Plus500

Last but definitely not the least in our top 10 forex brokers 2021 list is- Plus500. It’s an Israeli-based CFD broker. Established in Israel in 2008, it is regulated by many top-tier international authorities such as:

- UK’s Financial Conduct Authority (FCA),

- Cyprus Securities and Exchange Commission (CySEC) (#250/14), and

- The Australian Securities and Investments Commission (ASIC)

Plus500 is a reliable platform given it is listed on the stock exchange, is regularly discloses its financials, and is internationally regulated.

Minimum account and fee:

Plus500 trading fees class is low. The user-friendly account opening process is dictated by the following fee structure:

- Withdrawal Fee: Traders can take advantage of up to 5 free withdrawals a month. Once that number is surpassed, a fee might be incurred.

- Minimum Deposit: The user of Plus500 needs to have a minimum deposit of 100 U.S. Dollars. The deposit can be made via credit card, or by electronic wallet like Paypal and Skrill.

- Inactivity Fee: Plus500 charges 10 U.S. Dollars per quarter after an inactivity period of 3 months.

- Overnight Funding Fee: Pluss500 charges overnight funding fees by either adding to or subtracting from account when holding a position for a specific time.

- Currency Conversion Fee: Pluss500 charges 0.7% of the trade as currency conversion fee.

- Guaranteed Stop Order Fee: Pluss500 charges fees, if you choose this feature.

Pros and Cons of using Plus500:

Plus500 offers a user-friendly trading platform, and a very useful mobile trading platform. In this section, we will enlist both the good and the not-so-good factors about Plus500. SP let’s go:

| Pros | Cons |

|

|

|

|

|

|