In our 2021 broker review, we will be analyzing Markets.com in-depth, to see how much this broker platform stands when it comes to aspects like- authenticity, efficiency, security, prices, user-friendly technology, etc. Let us start by introducing you to what is Markets.com is all about?

Introducing Markets.com:

Markets.com is a subsidiary of LSE: PTEC, a United Kingdom-based company. Playtech was founded in 1999, and it acquired TradeFX, who was the previous owner of Markets.com, in 2015. The website of this trading platform is operated by Safecap Ltd. (Safecap Ltd is a daughter company of Playtech PLC.)

It is a highly safe broker and offers a low-risk environment for forex and CFD trading for its clients as it is regulated in two tier-1 jurisdictions. Despite attaining its place in top brokers globally, Markets.com is always on a look-out for how to push the envelope further in order to offer seamless service to its clients.

- One of the components of FTSE 250 is Playtech PLC. And Playtech PLC being the parent company of Markets.com, one can understand how robust this brand is.

- The presence of Playtech PLC also ensures a strong financial backing for Markets.com.

Is Markets.com legit?

There are many resources online that talk about the variety of services Markets.com offers for its clients. But are those claims legitimate? In this section of the article, we will shine light on this key point.

Deciding whether a forex broker is legit or not, many factors contribute to the decision. Things like first-hand experience, years of expertise in the field, market performance, case-studies, clients’ feedback, background check of the company, etc. So, here are the key factors that vouch for Markets.com’s authenticity:

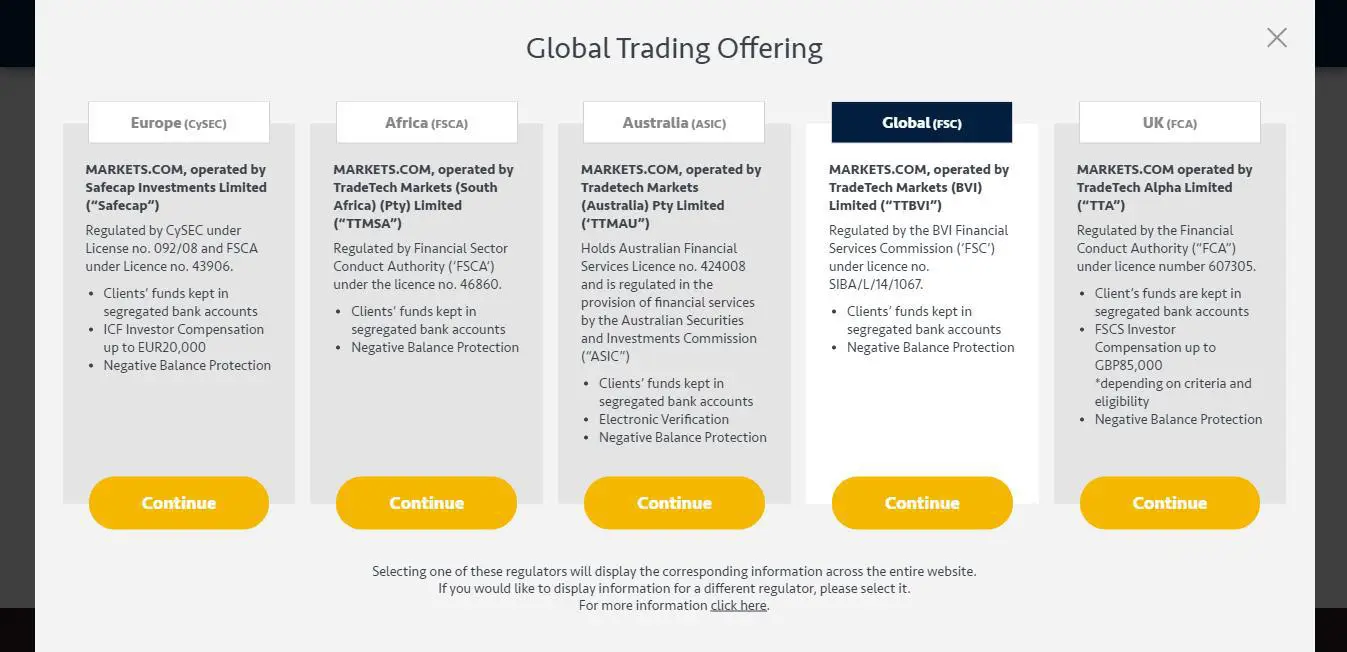

- Markets.com is regulated by the Cyprus Securities and Exchange Commission (‘CySEC’) under license no. 092/08. It is also regulated by- ASIC, FCA, and FSCA.

- It is a very safe broker platform and offers low-risk trading for forex and CFDs, given it is regulated in two tier-1 jurisdictions.

- Markets.com holds years of expertise. This offers the clients a thorough detailed-check on the company’s history and its performance by far.

- Markets.com has a long history in the retail FX market, which extends a sense of trust for its clients.

- It scores 97 in the trust score, which is a good reflection of its market performance by far.

- Along with trust, Markets.com also is a multi-level and far-reaching platform. Through services and products like- stocks, bonds, cryptocurrency, CFDs, energies, metals, etc., Markets.com gives its clients good range access, which enables them to trade in a broader spectrum with confidence.

In the following image, which is taken from the official website of Markets.com, you can clearly see how well the trading platform is regulated across the globe:

You can clearly see that Markets.com is indeed a trustworthy and legit brokerage platform. Above were just a few glimpses in how trustworthy is Markets.com. In our 2021 Markets.com review, we will give you great insights into what is in store for you when you choose this trading and brokerage platform.

What is the trading-experience like at Marekts.com?

Now that we have established that Marekts.com is a legit trading platform, now it is time to share with you what we found out in terms of various trading experiences at Markets.com. This trading platform offers its clients with a great range of trading instruments and allows them to access the market through different trading platforms. In this section of the brokerage review, we will walk you through the various aspects of the trading experience at Marekts.com:

What are tradeable products and markets available at Markets.com?

Markets.com offers its users to trade on more than 2200 different kinds of CFD markets. The clients can trade in their chosen field that can range from stocks, indices, fiat currencies, cryptocurrencies, bonds, ETFs, IPOs, and unique Index Blends.

Markets.com also offers a good range of CFD markets to its users to trade at. To give you an overall understanding of the possibilities, here is a list of the variety you can avail at Markets.com:

- Types of Instrument class available at Markets.com:

- Fiat currencies

- Indices

- Commodities

- Cryptocurrencies

- Bonds

- Shares

- ETFs

- Blends

- Types of Instruments available at Markets.com:

- In fiat currencies, the clients at Markets.com get primary, major, minor, and exotics instruments. Examples include- AUD/CHF, EUR/USD, GBP/CAD, NZD/CAD, USD/SEK, EUR/PLN, GBP/ZAR, and so on.

- When it comes to Indices, Markets.com offers Futures, cash, and primary instruments. For instance- UK100, Hong Kong 45, Germany 30, USA 30, tech 100, etc.

- In commodities class, Markets.com offers metals, agriculture, and energy instruments. Examples of this category include- gold, silver, platinum, copper, brent oil, natural gas, coffee, corn, soybean, wheat, etc.

- In the cryptocurrency instrument class, Markets.com offers cryptocurrency CFDs. Markets.com offers Bitcoin Cash (BCH), Dash (DASH), Ethereum (ETH), Litecoin (LTC), and so on.

- In the Bonds instrument class, Markets.com offers Bond CFDs. Examples of this include- German 10 Year Bond, US Treasury Note 10 Year Bond, and so on.

- For Shares instrument class, Markets.com offers global share CFDs. Examples of this category include- Facebook, Apple, Amazon, Tesco, Barclays, Allianz, EDF, Airbus, Deutsche Bank, and so on.

- In the ETF instrument class, Markets.com offers ETF CDFs, such s iShares MSCI South Korea, Currency Shares Euro Trust, iShares Russell 200 Index, Energy Select Sector SPDR, etc.

- Last but not least, in the blends instrument class, Markets.com offers Unique Index Blend CFDs, which includes blends like Brexit Winners Blend, Cannabis Blend, Dogs of the Dow Blend, Warren Buffet Blend, Trade War Losers Blend, and so on.

Please Note: Markets.com offers commission-free trading to all its clients. Yet the spread costs and swaps do vary based on the individual markets and trading platforms.

All about account Opening, withdrawal, and deposits:

Markets.com offers different kinds of accounts for its clients to choose from. They are:

- MetaTrader 4 Live accounts

- MetaTrader 5 live accounts

- Demo trading accounts

- Markets X accounts

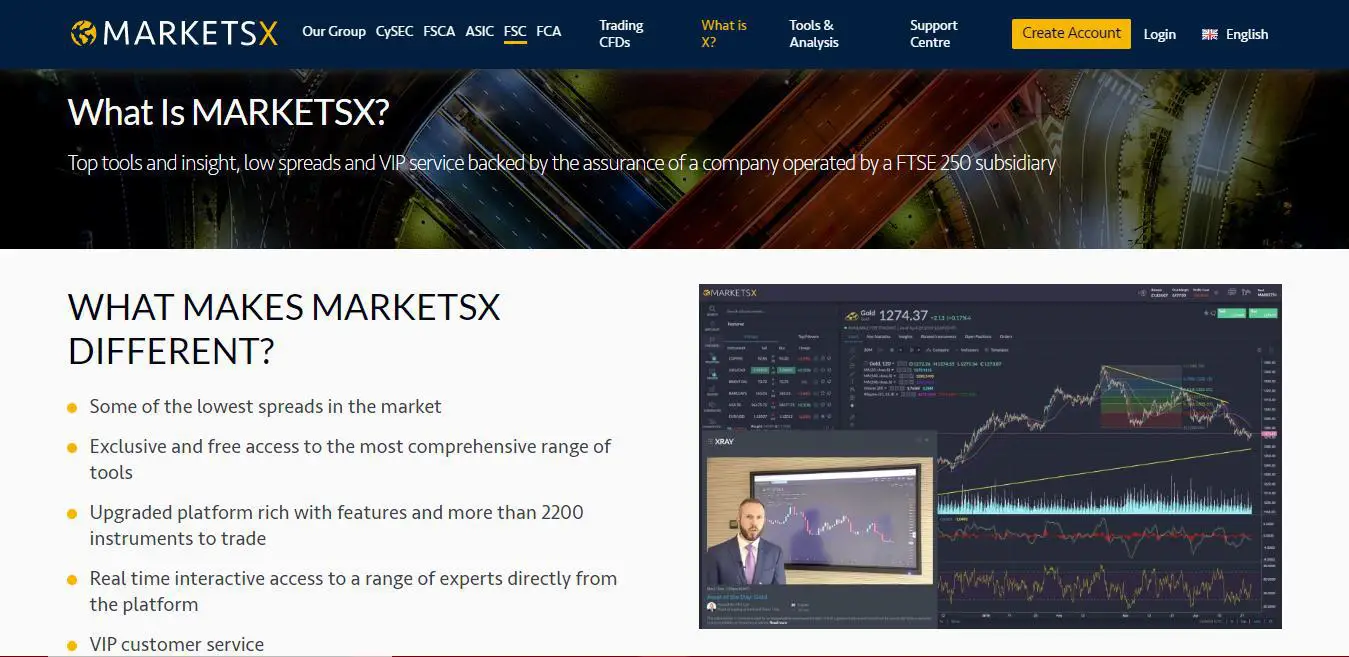

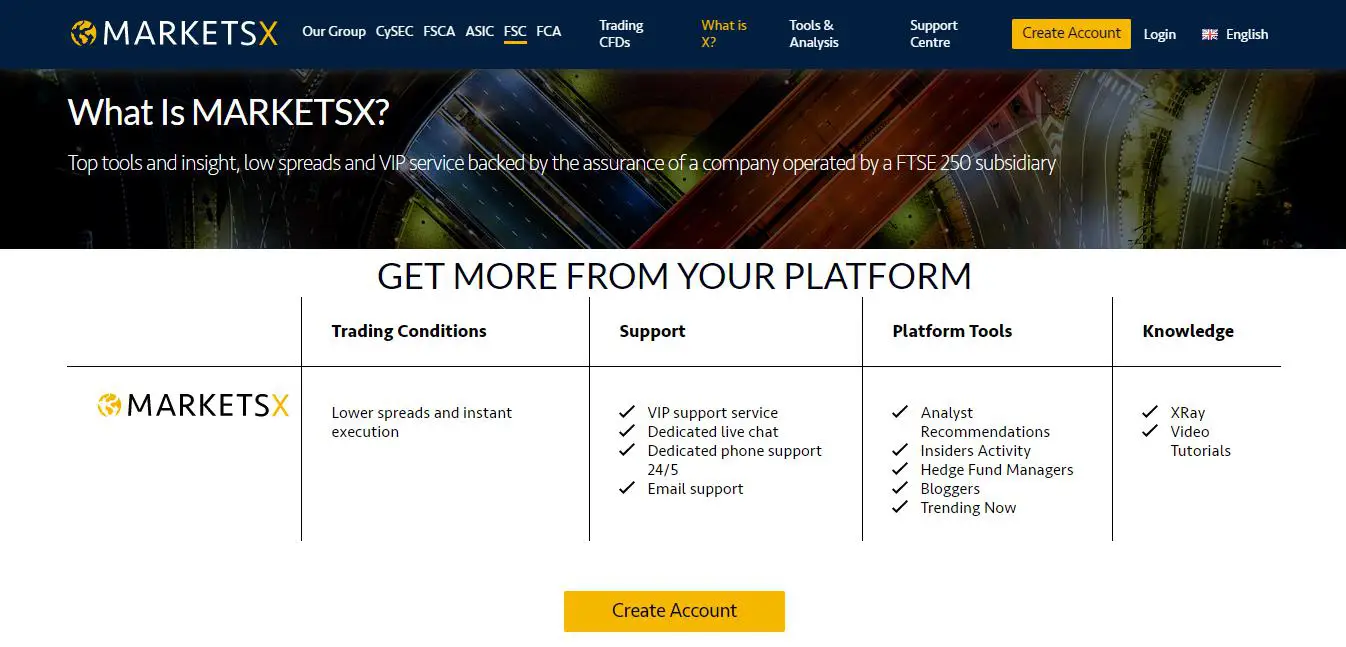

The image from the official website of Markets.com shows that the flagship account of Markets.com- Markets X accounts are very interesting ones are feature-rich in nature. They offer lower spreads, VIP support services, and many advanced trading tools. Opening an account at Markets.com is a very straight forward and quick process. Markets.com’s accounts cater to both the beginners as well as highly experienced professional traders.

- Opening an account at Markets.com:

Here are the steps that are required to open an account at Markets.com:

- Click on the ‘Create Account’ option on the homepage of the Markets.com website. This will lead you to the registration page.

- After you fill out the registration page, Markets.com will ask you preference of whether you wish to open a live trading account- ‘real mode’ or a demo trading account- ‘demo mode.’

- After the selection of the type of preferred account, the user then fills out the mandatory customer information. Four more sections related to financial information, trading experience, and knowledge then need to be filled out by the user in order to proceed.

- Now, at this stage, the user is asked to verify their identity, residence. They can do so by uploading authentic proof of identity documents on the platform.

Upon successfully setting-up the Markets X account, the user is now free to enjoy the feature-rich web trading platform. He or she can now download the MetaTrader 4 or MetaTrader5 as per their preference.

Here you can see how the account opening page looks at the official website of Markets.com:

-

- What is the minimum deposit at Markets.com?

Once you have opened an account at Markets.com, you would need to maintain a minimum deposit to operate the account.

-

- Markets.com asks its users to maintain $/£/€ 100.

- Please note that for those who wish to use the Markets X accounts, the minimum deposit is £250 or equivalent in local currency. With Markets X, the user can enjoy lower spreads, VIP support service, and advanced platform-tools.

-

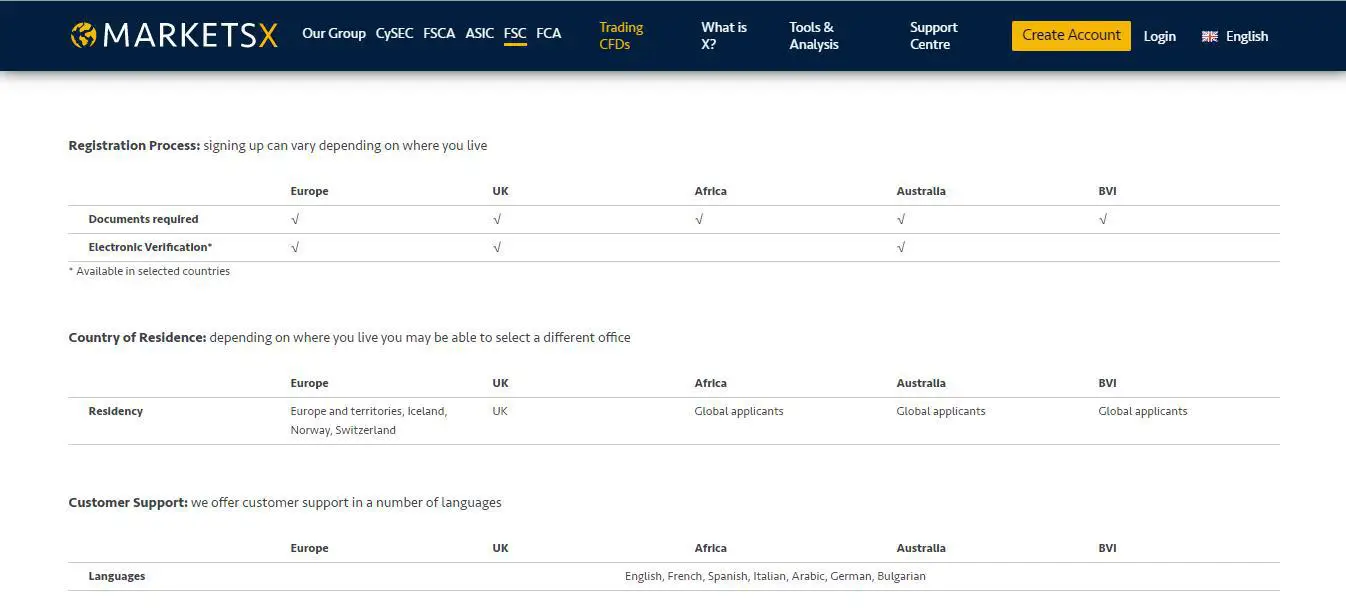

- Registration process:

The registration process varies at Markets.com based on the geo-location of the user. Each country has its own regulatory body with different rules and expectations. The users of Markets.com are allowed to select to trade under more than one regulator in order to access the various features. (It is observed that the users tend to choose more than one regulator due to the difference in the leverage that different regulators offer.)

Excellent customer support:

Along with offering a very easy registration process, Markets.com backs it up with excellent customer services too. Here is a screenshot from the official website of Markets.com:

Markets.com offers customer support in the following languages:

- English

- French

- Spanish

- Italian

- Africa

- German

- Bulgarian

Deposit and Withdrawals at Markets.com:

Markets.com supports its clients with all kinds of queries regarding deposits at the trading platform. Here is a glimpse from the official website of Markets.com:

At Markets.com, there are many ways through which the user can deposit and withdraw funds. These routes include:

- The traditional bank wire transfer system.

- A credit card is accepted form all the major brands.

- Neteller

- Skril

- PayPal

Fees for depositing, withdrawing and transferring funds at Markets.com:

Along with allowing multiple ways of withdrawing and depositing funds, Markets.com does not charge any deposit or withdrawal fees. In addition to this, you should know that sometimes banks involved in the deposit or withdrawing process may incur some charges.

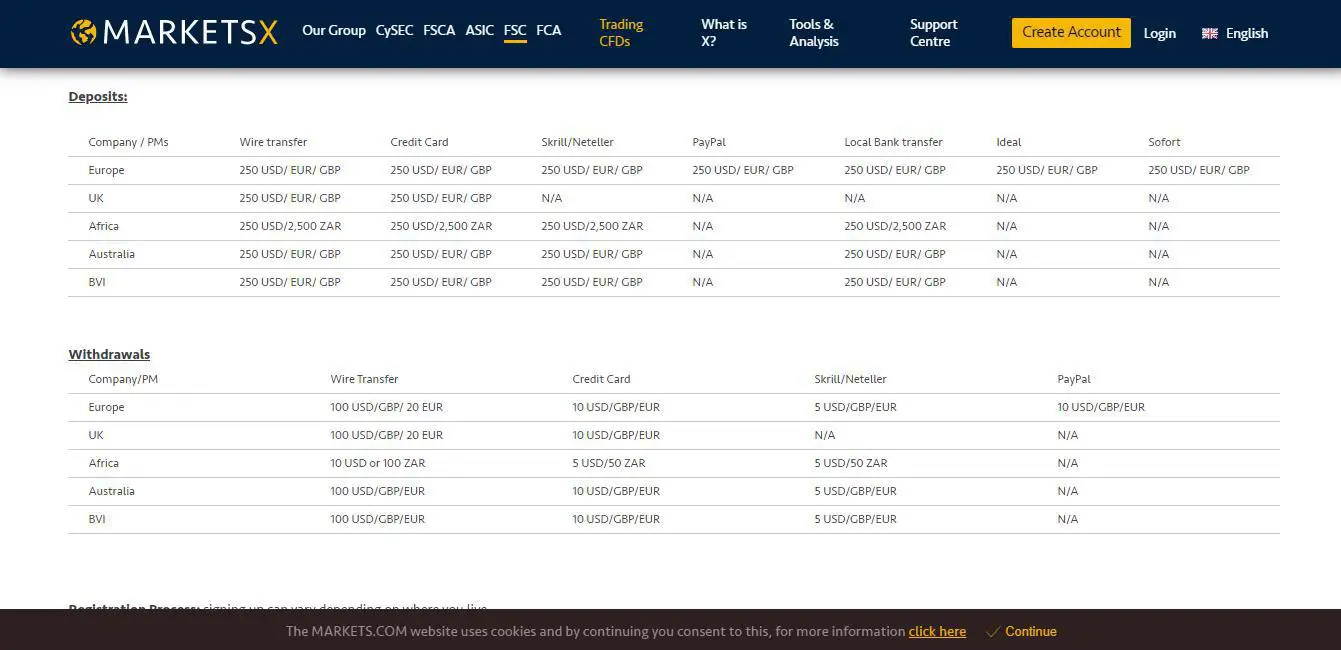

The fund’s deposit methods vary from country to country, and so does the other related details. Here, in the screenshot from the official website of Markets.com, you can see all the details:

At Markets.com, only the European users can use PayPal, Ideal, or Sofort when it comes to depositing and withdrawing funds. There are minimum transaction fees that Markets.com charges. It is as follows:

- A minimum amount of deposit is $/£/€ 100 or more

- There exist a lower minimum amount for withdrawing funds based on what medium the user has chosen.

Other fees and commission for other services at Markets.com:

- Markets X:

This is the premium account that Markets.com offers. The minimum deposit for the Markets X account is $250.

- Variable Spreads:

Markets.com offers variable spreads for its forex pairs. This allows Markets.com to compete with other multi-asset brokers in the market. Although, the minimum listed spreads are still quite higher

- Average spreads:

At Markets.com, the spreads are available as low as 1.9 pips on the EUR/USD and 3.0 pips on its MT4 offering. Despite them being advertised as low, they are still higher than the spreads offered by other broker platforms, who offer variable or floating spreads.

In how much time the withdrawal process get completed?

The withdrawals at Markets.com usually take anywhere between 2 to 8 days n order to be fully processed.

Pros and Cons of using Markets.com:

|

Pros |

Cons |

|

|

|

|

|

|

|

|

|

Markets.com trading tools:

Markets.com offers a variety of trading tools. In this section of the review, we will quickly walk you through them:

- MarketsX charting:

This tool offers an exhaustive range of 90 indicators for the technical analysis. It is higher than the industry average, but on the other hand, Markets.com offers only 4 drawing tools.

Markets.com offers advanced charting, which gives professional-grade services which are very easy to use:

- Markets X usability:

The web trader of Markets.com is a very useful platform that targets to offer a seamless platform for its users.

- Meta Trader:

Markets.com offers two types of Meta Traders- MetaTrader4 (MT4) and MetaTrader5 (MT5). They are highly useful for the algorithmic trader. The pricing of this tool has been found higher in comparison to other platforms.

- Mobile Trading:

Markets.com offers MT4 native app as well as a proprietary mobile app. The latter is a mobile version of the web-based platform Markets X. The mobile app by the Markets.com is offered for both the Android and iOS devices.

|

Pros |

Cons |

|

|

|

|

Conclusion:

In summary, we would say that Markets.com is indeed a safe, legit, and trustworthy trading platform. It offers a good balance between user-friendly functions and features, which is backed by intelligent functions and research such as third party research, integrated tools, reports-backed research, highly useful educational programs such as webinars, educational videos to uplift its services higher. It is a very good platform that suits beginners, traders with intermediate and expert skills. It has finished Best in Class across the following categories in 2021:

- Ease of Use

- Beginners

- Trust Score