Overview

Before we start on Vanguard reviews let us know about the platform and its beginning in brief;

It was the year of 1951 when an undergraduate student of Princeton University, John C. Bogle while completing his thesis conducted a survey where he found out that most mutual funds fail to earn more than they would have earned if invested in broad stock markets indexes. After working with the Wellington Management Company, he got fired due to an unsuccessful merger with one company. Soon, he formed Vanguard and assured Wellington that Vanguard funds would be listed alphabetically next to Wellington funds.

In 1976, with Wellington BOD’s approval, Bogle formed the First Index financial Investment Trust, which is now called Vanguard 500 Index Fund. This trust raised $11 million in its IPO, banks managing this IPO were expecting a minimum of $150 million, and hence suggested Bogle to cancel the fund, but he denied. Bogle convinced Wellington to merge its funds with the Index fund. This took assets to $100 million.

Asset growth started with a good acceleration after entering the bull markets in 1982, and soon the other mutual fund companies started copying the indexing model. In December 1986, the vanguard group inc launched its second mutual fund. In December 1987, came the third fund. More funds were launched over the next five years. Many Vanguard funds (the S&P 500 index fund & more) became among the largest funds in the world, and Vanguard became the largest mutual fund company in the world.

Vanguard Review for better financial decisions:

Vanguard Brokerage entered the markets in 1983. The late founder of the broker, John C. Bogle, established it to facilitate its clients to deal with stocks & bonds while complementing them with their mutual fund holdings. At the time of the establishment, it was never meant to deal with short-term investors or frequent traders. However, now it does serve investors who are philosophically complementing Vanguard’s approach to investments. Vanguard provides them with a low-cost brokerage personal experience.

Here are a few key features of Vanguard offers:

- Account–holders with a huge balance are treated with a dedicated phone support line.

- Vanguard does not accept order flow, equity trades payments.

- It has a high-yield, low expense ratio markets fund called Vanguard Federal Money Markets Fund. The broker automatically sweeps brokerage account cash balances into it.

- Who should think of investing in vanguard group inc:

- Vanguard specifically focuses on those investors who tend to buy and hold. The broker believes in ETFs and sees a better growth opportunity in ETFs ownership, and hence is striving to optimize its ETFs investment experience.

Recently, in March 2019, Vanguard personally launched its Select ETFs. It is a list of 13 ETFs that can provide each investor account with the building blocks to build a diversified financial investment portfolio. ETF vanguard-based portfolio is a perfect fit for you if you wish to build a diversified investing account through which you will periodically rebalance the investment. However, if you are one of the active traders, Vanguard might not satisfy your expectations.

Here you get the pros and cons of the Vanguard financial investment brokerage services:

Van guard review will not be complete without the pros and cons.

Pros

- vanguard group inc offers you tools for your long-term planning goals like retirement.

Cons

- Investor accounts do not get real-time market data.

- Watchlists are not shared across the platform.

- Very few news feeds are available compared to others who provides online brokerage services.

- Vanguard is open for US citizens only. Another citizen can’t open an investment account.

Range of Offerings

vanguard group inc is offering its investors a considerable large list of financial investing assets/products. Apart from stocks, and ETFs, accounts can invest in the following products:

- Penny stocks

- Vanguard Mutual funds (All Vanguard funds are commission-free)

- Bonds

- Single options

- Multi-leg options

- Vanguard Personal Advisory Services.

- & International

Order Types

Vanguard provides limited order types on the platform. Investors can place only three order types: market, limit, and stop-limit orders. Apart from these, one cannot expect other options like trailing stops or conditional orders. Once the trade is settled, investors think of dividend reinvestment. But not before that!

At the beginning of the year 2021, the broker joined the zero-commission brokerage movement. It joined this movement a little later as compared to other online brokers as Vanguard already conducts most of its trades without charging commission due to its no-commission ETFs offerings or Penny Stocks trades.

- There is no per-leg commission on options trades.

- $20 annual fee for small accounts (below $10,000 in Vanguard funds)

- Per contract commissions of Vanguard are $1.

- Mutual fund commission (outside No Transaction Fee program) is $50.

- Clients with over $1 million in their accounts pay no commission.

- An order for 50 options contracts is $50.

- There are no fees for inactivity or account closure or transfer. Receiving wires, sending checks, and trade confirmations are free of charge too.

- There is a $10 fee for outgoing wires.

Security

A crucial part of writing Vanguard reviews is talking about its security and safety measures.Investors or investing account holders can log in on the platform using biometric (for mobile app users).

Vanguard holds the excess SIPC insurance by Lloyd’s of London and London Insurers. It has an aggregate limit of $250 million, other than to those funds which returned in a SIPC liquidation. The aggregate for any single customer is $49.5 million.

Minimum Balance and Initial Deposit: Vanguard Reviews

- Vanguard expects a minimum financial investment amount of $3,000 for Vanguard mutual funds, per person. Some investors might find this amount huge (as this is the initial financial investment .

- However, if traders/investors wish to deal in Vanguard ETFs, it demands only one share and hence, suitable for beginners.

- Vanguard also offers admiral shares with lower annual fees. To be eligible for this, one has to invest:

- Minimum $10,000 in most Vanguard index funds (that offer Admiral Shares).

Or

Minimum $50,000 or more in Vanguard actively managed funds (that offer Admiral Shares).

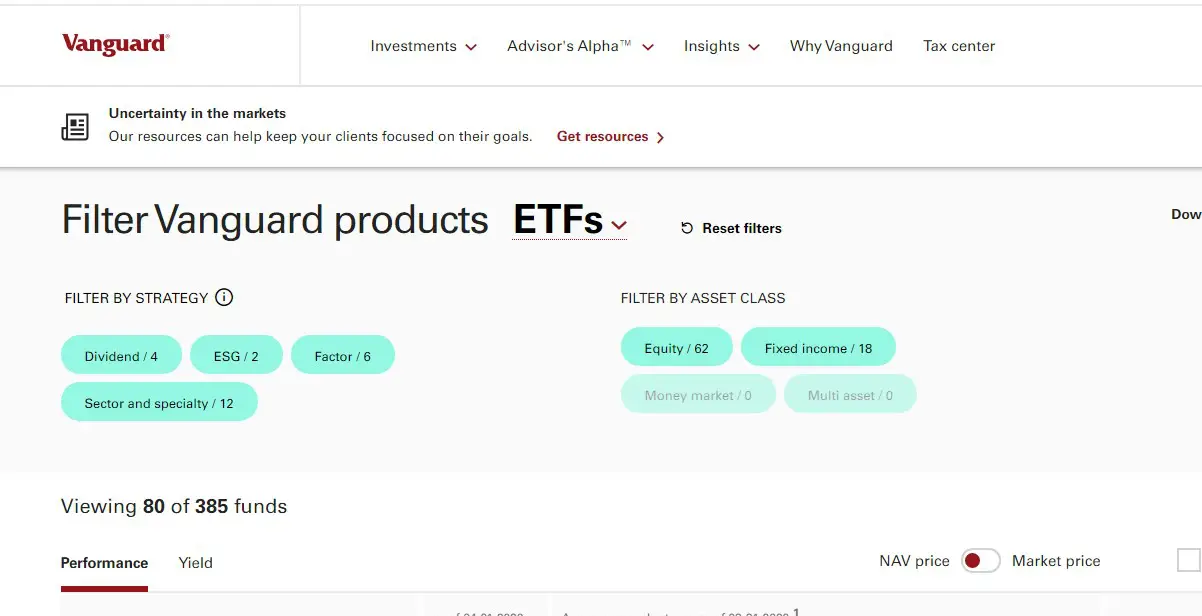

Mutual Fund and ETF Screener

Though Vanguard is not offering many services on the UI/UX front, some of its features are very classy and user-friendly. Vanguard offers a mutual fund & ETF screener to help traders find the right fund that meets their investing criteria. There are multiple filters using which one can select the best possible product depending on:

- Asset class

- Minimum deposit amount

- Level of risk

- Share class

- Tax efficiency.

Once the investors find the right Vanguard funds, they can invest directly.

Is Vanguard or Fidelity better? – An interesting question in Vanguard reviews

Both Fidelity and Vanguard are two of the biggest financial investing platforms in the world. Till the year March 2019, Fidelity boasted 30 million individual investors accounts on its platform and $8.3 trillion funds as total customer assets. On the other hand, the vanguard group inc had more than 30 million investors accounts and $5.6 trillion in its customer assets along with its brokerage’s services.

Both brokers have robust market value and reputation. Both offer a wide selection of options on ETFs, low-cost mutual funds, and other related products/instruments.

Fidelity, which was founded in 1946, offers a robust trading platform, excellent screeners, and smooth trade executions. Vanguard, launched in 1975, offers an impressive product range of low-cost mutual funds and exchange-traded funds (ETFs). The platform focuses on buy-and-hold investors.

Fidelity has well-built trade execution algorithms that avoid payment for order flow and enhance price improvement. The platform does its backtesting in Wealth-Lab Pro. Wealth-Lab Pro deals with clients who have a minimum $25,000 balance in the account and who annually place a minimum of 36 trades ( these trades can be either stock, bond, or options).

A Wealth-Lab Pro client has to have a minimum of $100,000 balance amount and should place at least 500 trades if the client wishes to enjoy automated trading. Vanguard’s sole focus is to enhance the price improvement. It doesn’t offer to backtest.

Usability

- Fidelity is very much user-friendly. It is easy to open an account on this platform.

- It offers three platforms to the investors: Its web version, Active Trader Pro, and Fidelity’s Mobile App.

- The platform treats Buy-and-hold investors very well, and they will find everything they want on the platform.

- For frequent traders, the platform has built Active Trader Pro which provides facilities like charts, screeners, latest news, and alerts.

- However, Fidelity does not allow you to trade futures, crypto assets, or options on futures.

Vanguard allows you to open the account online; however, you will have to wait for several days before it gets accepted and you get to log in. In case the investor wants to trade in options, the wait will be even longer.

- Trading ETFs, stocks and some fixed income products can be done online. But, for other asset classes, you will have to place an order through a call.

Mobile platform:

- Fidelity has a good app with decent functionalities. Investors can trade in every asset class, except bonds.

- Vanguard’s mobile app is simple to navigate, easy to use, and buying & selling orders are smooth.

Trade Experience

Desktop:

On this user-friendly platform, investors can set certain filters by default. Whether one wants to use a market or limit order. Traders are allowed to use these features while placing a trade. For frequent trading, the platform has provided investors with Active Trader Pro. This is a more powerful stage and allows customization with filters, order entry tools, alerts, etc.

To place orders for later entries, one can follow three steps-

- Standard trading

- Time-delayed trading

- Conditional orders.

Vanguard’s brokerage service platform, on the other hand, has a different structure. As it is designed especially for buy-and-hold investors, the features, facilities are different. Placing a trade might take time as compared to Fidelity. One has to cross many hoops. No real-time data until one opens the trade ticket, and charts are provided. Usually, data is shared with a gap of 15 min. One has to keep refreshing the page to get the new updates.

Mobile Experience

Fidelity’s mobile app:

- It is easy to use and navigate.

- It lacks in providing fundamental research and charts in a large amount.

Vanguard offers

- Old fashioned mobile app.

- Less features.

- No charting.

- One can monitor the positions & news and place orders as a buy-and-hold investor.

Range of Offerings

Both platforms allow you to trade almost everything you would expect to trade as an investor. Accounts can deal with equities, bonds, options, penny stocks, ETFs, and mutual funds. Fidelity allows Forex trading.Neither Fidelity or Vanguard allows trading in futures, options on futures, or cryptocurrency.

Order Types

Fidelity’s web platform and Active Trader Pro can be used to place a variety of frequent orders., One Can deal with conditional orders such as OCO and OTO. Fidelity does not allow conditional orders on the mobile app yet. One can stage orders for late entry using Fidelity platforms.

Vanguard, on the other hand, allows only those orders which its target customer base (Buy-and-hold) typically use. It includes market, stop-limit, and limit orders. Staging late entry orders are not allowed.

One can select specific tax lots (before placing actual orders) on both platforms.

Costs

- Both brokers charge no commissions for US-based online customers trading in equity, ETs, options, & OTCBB.

- Fidelity shares the revenue generated from lending the stocks from your account to other traders. Vanguard does not share the revenue it generates.

- Fidelity has a $0.65 per contract option fee; While Vanguard has a $1 per contract option fee.

- For broker assisted mutual funds trade (which do not come under no-transaction-fee), Fidelity charges $49.95.

How these brokers earn is from the differences of an amount between what investors are paid (on the idle cash) and what investors earn on balances. Both brokers allow investors to move cash into money market funds in search of higher interest rates.

Customer Service

Fidelity has a strong customer service system. It runs a 24/7 help through a phone line, an online chat that runs for specific hours, and a secure email portal through which investors can share their queries and doubts. Fidelity also has a chatbot to deal with customer related issues.

Vanguard has a phone-based customer service for investors, which is available from 8 a.m. to 8 p.m. (Eastern Time Zone) Monday to Friday. Chatbots are not deployed at the Vanguard platform yet. Twitter can be used to reach the broker and receive a response in 2-3 hours. One can message the broker using the official website.

Security

When it comes to security measures, both platforms are up to the mark. These platforms have maintained a positive market change reputation. They follow the required security standards. They both allow biometrics login procedures and provide robust protection against a data breach.

Fidelity holds excess Securities Investor Protection Corporation (SIPC) protection along with a per-customer limit of $1.9 million on cash awaiting investment. This is the maximum excess SIPC insurance available to anybody in the brokerage industry.

Vanguard’s excess SIPC protection (by London insurers), caters to every client with $49.5 million for securities and a cash limit of $1.9 million per client. The aggregate limit set for all clients is $250 million.

Usability

Here is a Vanguard review talking about its usability or utility value:

Starting investing in Vanguard is a little bit time-consuming as compared to other platforms. Vanguard starts with opening an account online. However, one will have to wait a few days before the actual trade can start. If you are seeking investments through options trading or trading on margin, the wait may get a little longer as the account has to sign relevant documents before this. This time is a bit longer as compared to other online brokers.

The site has an old fashion experience or feel, and the personalization is also very limited. However, the site is working on it. Investors or traders can deal with fixed income products, FTFs or stocks ETFs, through the online platform; for other products, the investor will have to call the broker and place the order.

As far as the user experience of the mobile app is concerned, the app is simple to navigate, and buying & selling is easy.

Is Vanguard good for beginners?

Why not? As the platform focuses on buy-and-hold investors, it also provides investors with access to professional know-how. Vanguard funds are the best mutual funds for beginners because of their broad variety of ‘no-load funds’. These funds come with low expense ratios. But even professional investors can use the platform for its reach, wide range of product offerings and security.

How much do I need to invest in Vanguard?

The minimum initial asset acceptable on Vanguard is $1000 for its Target Retirement and Vanguard STAR Funds. For most of the other funds, the initial financial investment amount goes to $3,000.

How do I withdraw money from Vanguard?

As per the information available on Vanguard (same is applicable to VanguardUK and Vanguard Australia users).

If the amount you wish to withdraw is already available in liquid form or cash in the account, then this is the procedure:

Login.

- Go to the account/profile.

- Go to my portfolio Menu.

- Select the ‘Payment’ option.

- Choose Money Out.

- You will see an option to withdraw cash.

Customer Service

Customer service through calls is available from 8 a.m.–8 p.m. Monday to Friday. Chatbot’s online chat system is not yet deployed on the platform. However, one can send a short message using the web site page without expecting a real-time reply.

It has a Twitter account where one can expect a reply within a few hours.

Bottom Line is:

Vanguard review after going through the above factors would help us reach a conclusion that though Fidelity offers fantastic services to the investors, it is a perfect fit for active traders. Plus, it does not support future trading. Vanguard is recommended for ‘Buy-and-hold’ investors who prefer simplicity over fancy. Those who wish to leverage professional advice on some of the best funds in the market (that too at low cost), can go for Vanguard. If we go by Vanguard’s official website, it claims that 87% of its funds have performed better than other brokers (on average) over the last 10 years.