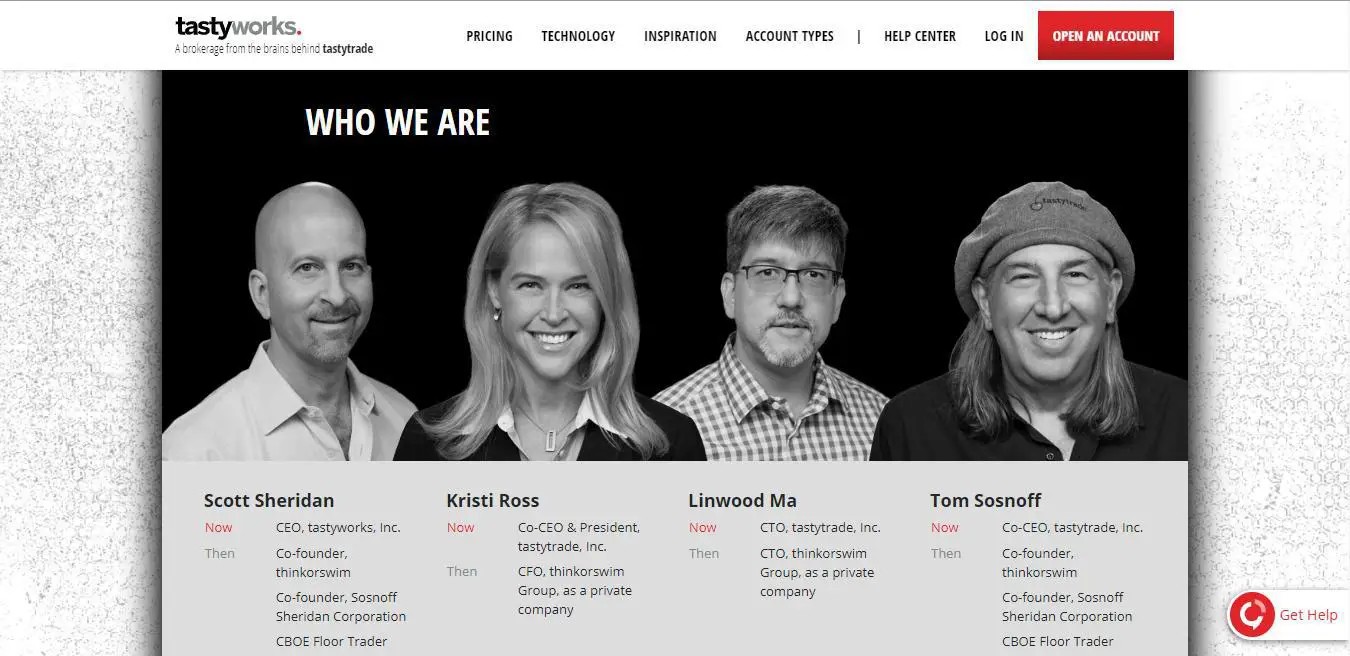

Tastyworks is a relatively new US broker who’s main focus is on options trading. Behind Tastyworks are the experts from Thinkorswim, which is operated by TD Ameritrade. Tastyworks’ headquarters is in Chicago. It is totally a legitimate trading platform. Tastyworks is a part of the Tastytrade group. Tastytrade, which was founded by Tom Sosnoff in 1999, has been giving insights on the day trading through video platforms since its commencement. Tom Sosnoff is the co-CEO of Tastytrade, which is the parent company of Tastyworks. Tastytrade plays a crucial role in helping the investment industry grow by offering in-depth financial information, entertainment, intelligent investment strategies related to stock trades, and options trades. It offers this information through online programs from its official website- Tastytrade.com and other platforms such as- iTunes, Apple Radio and TV, Amazon Fire TV, Roku, YouTube, and so on, now in mobile app.

Here through the screenshot from the official website of Tastyworks Canada, you can see how strong the backbone of the trading platform is. The experts and their respective experiences speak for themselves!

Given Tasty works is a new platform, many questions bubble around it and around the services it offers. In this Tastyworks review, we will be looking at all those questions to help you gain a better insight on the trading platform. So without wasting any time, let’s begin!

Is Tastyworks safe?

Because Tastyworks is a new broker-dealer and is causing new waves in the investment world, it is naturally raising many questions about itself. It is natural that human beings feel a certain unease about the unknown. It does not necessarily mean that there is something odd about the company and its legitimacy. In this section of our Tastyworks review, we will explain how safe Tastyworks is as a trading platform.

Tastyworks is a very safe trading and brokerage platform. Tastyworks has ensured all the necessary safety measures and offers the highest levels of security to all its clients.

Yet, the nature of the trade and the investment world is always inherently risky despite which trading platform you choose.

How safe Tastyworks is as a trading platform, the following information may help you get your satisfactory answer.

Tastyworks is a regulated trading platform:

The trading platform is regulated by the following world-class regulatory bodies that give it a very great potential to offer investor protection:

- FINRA (the Financial Industry Regulatory Authority, Inc from the United States)

- Securities and Exchange Commission (SEC)

- The National Futures Association.

Despite such impressive regulation, Tastyworks, on the other hand, also have some surprising downsides when it comes to the safety offered by the trading platform. This is not listed on any stock exchange. In addition, it does not give out any negative balance protection.

When it comes to considering safety, Tastyworks offers a mixed bag. Here are the pros and cons that will give an overall idea in a glimpse:

|

PROS |

CONS |

|

|

|

|

|

|

How to open an account at Tastyworks?

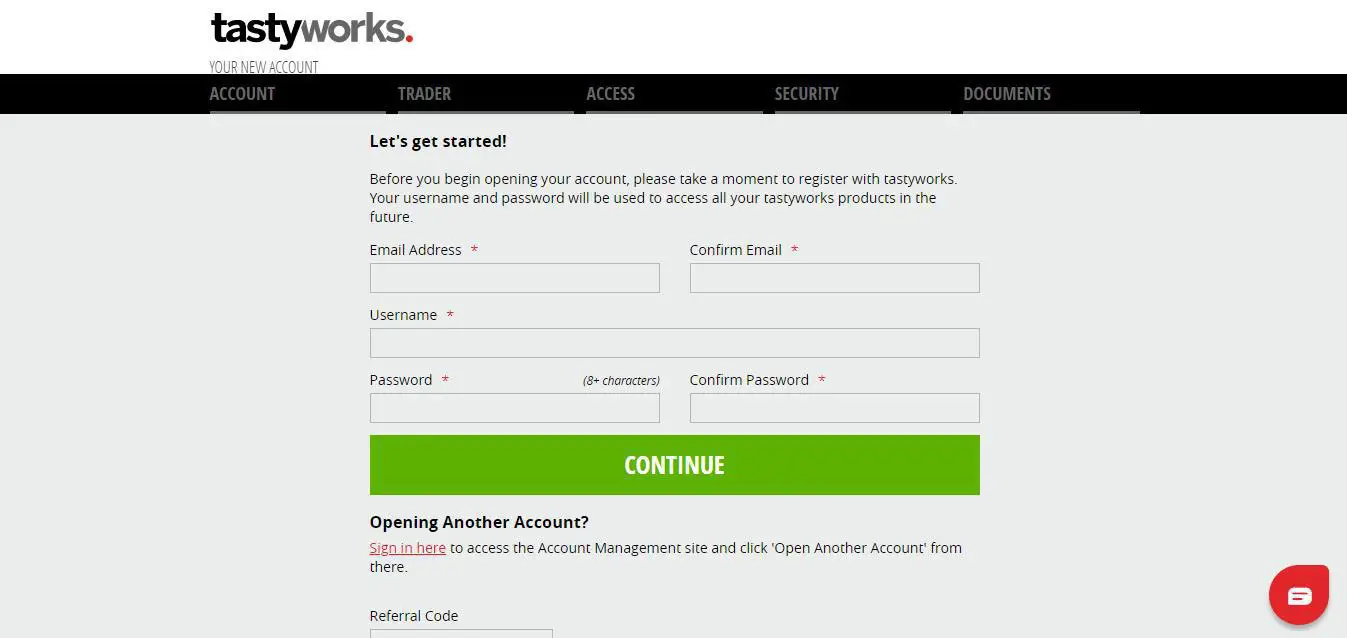

Opening an account at Tastyworks is a pretty quick and straightforward process. It is an entirely online process.

Types of accounts at Tastyworks:

There are the following types of accounts available at Tastyworks. They are:

- Margin accounts: This type of account allows the user to make use of leverage and borrowing mutual funds from the trading platform.

- Retirement accounts: This category of accounts is available only for U.S. citizens. There is a choice given to the U.S citizens to choose between traditional, self-employed, beneficiary accounts.

- Joint account: Tastyworks also allows the clients to open joint accounts with any other person.

- Corporate and Trust accounts: Tastyworks offer this account type for legal establishments in the United States.

The regulatory framework dictates that the opening of a broker account can’t be done instantly; nevertheless, the Tasty trade platform offers a very quick account opening process. It usually takes 1 to 3 days. Most of the cases accounts are opened within 24 hours. All you need to provide is the following information:

- The type of account

- Your personal information

- The information about your current employer. (Things like- name, address, phone number, email address are included in it.)

- Financial knowledge

- Details of your primary active bank

- Digital copies of your ID and proof of address

Who can open an account with Tastyworks?

Tastyworks allow many countries to open an account with them. The range covers almost all the EU countries, South and Central American countries, India, Indonesia, New Zealand, Turkey, etc. You can find a list of all the counties on the official website of the trading platform.

How much minimum deposit a trader needs to maintain at Tastyworks?

The active traders at Tastyworks are expected to maintain a minimum of:

- For cash accounts, the minimum deposit is ZERO U.S Dollars.

- For margin accounts, the minimum deposit is 2000 U.S. Dollars.

Tastyworks Investor Protection:

This section of our Tastyworks review will show you how this trading platform helps in protecting its investors in the times when something goes wrong. Tastyworks offers an amount of $500,000, which has $250,000 as a cash limit, as protection amount when anything goes wrong. This investor protection amount is offered to all its clients despite the country of origin. The regulator of the Tastyworks Investor Protection scheme is FINRA (the Financial Industry Regulatory Authority, Inc from the United States), and it is made possible through the legal entity- Tastyworks Inc.

Our research shows that all the clients of Tastyworks belong to a single US legal entity. This is regulated by FINRA. Why does this matter? Well, this fact ensures that the clients can claim for the US investor protection amount. The protection amount can be done by SIPC. Unforeseen incidents such as loss of cash, protection when the trading platform goes bankrupt, or other foreign attacks such as theft or hacking, or in cases of any natural danger. It is a big relief as $500,000 as investor protection amount is not a small amount.

What about the non-US clients?

Those who are not a part of the US, are still treated as per the same rules and regulations as any other US client would be treated. The same rules and terms of protection against any financial mishap apply to them as well. If we compare the investor protection amount, it is indeed higher than many EU investor protection schemes.

Which investments are protected by SIPC?

One should note that at Tastyworks, every investment is not protected by SIPC. Under SIPC investor protection scheme, the following is offered security:

And, here is the list of things that are not covered by the SIPC investor protection scheme:

Does Tastyworks offer any protection against negative balance?

It is one of the downers that Tastyworks does not offer any kind of protection against the negative balance

Takeaway point:

To summarize the answer- Yes, Tastyworks is indeed a very safe platform. But like any other investor and trading platform, here too it is the responsibility of the client to do the necessary background check of any company or platform or the broker platform before deciding to invest in it. Other than that, Tastyworks indeed takes care of all the safety requirements of its clients.

Does Tastyworks have paper trading?

In short, no, Tastyworks does not offer its clients with paper trading. Wait, before you form any judgments! Although Tastyworks does not offer paper trading to its clients, it offers something which is even smarter than that! In this section of the Tastyworks review, we will explain that alternative option in detail, just keep reading!

When you sign up for an account on Tastyworks, then you are eligible to apply for a very unique program in which you can:

- Trade with the mutual funds given by Tastyworks.

- The scheme allows the clients to keep up to 2 50 per contract U.S Dollars in profits.

- The irony is that in case the client loses, then he or she does not owe any amount to Tastyworks.

In this section of the Tastyworks review, we will explain in detail the exact steps to sign up for this scheme, the rules, and regulations around it, ways to go for extended periods of alternative trading at Tastyworks.

How does the alternative of paper trading work at Tastyworks?

- The first requirement is to sign up for Tastyworks’ alternative paper trading scheme.

- Next, the client needs to fund his or her account with a minimum of 2000 U.S. Dollars or more.

- Tastyworks claims that the amount of mutual funds the client deposits in his or her account is not at all at risk when it is used for paper trading options.

- After signing up, the client is requested to email Tastyworks to let the platform know that he or she has deposited mutual funds in their account. (The email address is usually mentioned on the page where the client lands after logging in to their respective accounts.)

- In the name email, you can mention that you are interested in the “trader challenge”. The futures traders’ challenge is a way to test the waters before you start to trade with your own money.

Other than the above points, you should bear in mind that you need to keep the money you won and the 2000 U.S. Dollars amount that you deposited for a minimum of 180 days after opening the account. Failure to do so can result in trading Tastyworks keeping all the money that the client wins. Tastyworks does not keep the initial deposited amount of 2000 U.S. Dollars.

Sounds too nice to be true?

Well, there are no free lunches out there. And so is true in this case too. Tastyworks does not allow the traders to do paper-trade before a short period of time, which the trading platform mentions in the ‘terms and conditions’ section. It is a crucial point since you need to know how to trade well. The upside to it is that the client is not at any risk of losing his or her own money. Yet in a case when he or she does not make any money and face any loss, the client misses the chance to win 250 per contract U.S. Dollars!

Does Tastyworks offer Portfolio Margin?

Yes, Tastyworks offers a portfolio margin. In this section of the in-depth Tastyworks review, we will walk you through all the details one by one. Portfolio Margin at Tastyworks involves massive leverage, special permission to avail it, and maintenance. Margin Portfolio is of national value and has its own risk to which we will cover towards the end of this section. Before that let’s dive into the details of Portfolio Margin at Tastyworks:

Types of portfolio margin offered by Tastyworks:

- No Margin (IRA, Cash Account)

- Tastyworks offer stock and cash-secured options

- There is no leverage offered under this category

- Standard Margin (Margin Account)

- Tastyworks offers leverage on stock under this category (2-1)

- There is also purchasing power relief on options

- Portfolio Margin (Higher stage of Margin)

- This one simply the next level of margin where the clients are offered more leverage on stock (6-1 and sometimes even more than that)

- The special calculation is also made available to the clients of Tastyworks under this category (IV and concentration)

So what is the minimum capital requirement for the Portfolio Margin at Tastyworks?

The minimum capital which the clients need to have for Portfolio Margin at Tastyworks is:

- For initial equities, it is 125,000 U.S. Dollars

- The required maintenance is 100,000 U.S Dollars

Other details about Portfolio Margin at Tastyworks:

To be eligible for the Portfolio Margin at Tastyworks, the clients need too:

- Getting passed in Tastyworks test is mandatory

- The client also needs to have entire option approval

The special concentration usually involves stress steps that usually range in +/- 15 percent for equities. It usually is covered within 24 hours.

Please Note:Although Portfolio Margin offers clients a sense of great confidence to manage the investments, there is an inherent risk too. There can be a risk around losing trading securities, options, futures, futures, forex, and so on. Therefore, a background workaround checking your risk capacity, your personal financial position, credibility checks on various investment schemes are strongly suggested before you put in your hard-earned money.

Can you day trade on Tastyworks?

Day trading allows the investors and traders to buy or sell financial instruments within the same day. It requires positions to be closed on the same very day before the market closes. Day trading requires intelligent market speculation and with prompt strategic moves. Tastyworks offers day trading to its clients and back it up with the following features:

- It supports its clients with conditional orders in order to help them with the constant stress of watching the market all day long.

- GTC (Good To Cancel) Orders, which allows the clients to place orders and to set profit targets above the market, with the freedom to set dates on GTC orders, without them being constantly present when the price gets triggered. It is an intelligent way to capture profits, and it also lasts more than one day.

- STOP Orders

- Tastyworks offer 45 DTE windows, which demand very little maintenance form the clients’ side.

PROS & CONS of using Tastyworks:

Tastyworks offers great services around options and futures traders in trading and backs it up with equally great and very useful educational and research-oriented efforts in order to help the client expand his or her knowledge around the trading platform’s methods around options trading, and also to have an intelligent insight on the market overall. It helps in supporting the traders’ efficiency to grow many folds.

On the other hand, when it comes to US stocks and stocks ETFs, it gets a little complex. It also offers bank wire transfers, but it is not a very cheap trading option. Further, Tastyworks does not offer any credit card or debit card deposits. Tastyworks is a great platform that supports the traders in beautiful ways, but given it has a lot to offer, it may get quite daunting for the new users.

Since Tastyworks services looked like a mixed bag, we decided to give you a quick run-through the pros and cons of the platform here:

|

PROS |

CONS |

|

|

|

|

|

|

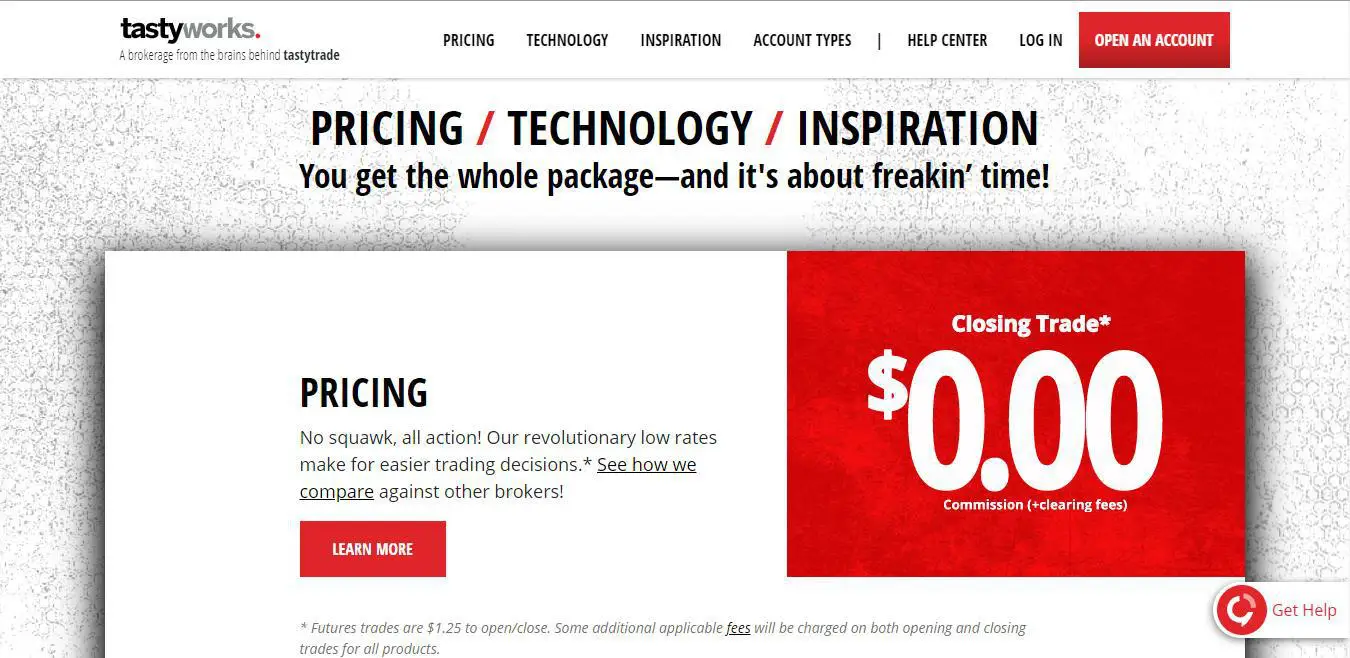

How much does Tastyworks charge as fees?

In this section of our Tastyworks review, we will walk you through the fee structure of the trading platform. Tastyworks is famous for charging very low fees. In addition, it does not even charge any inactivity fee.

But contradicting it, the trading platform charges a withdrawal fee. Please find below all the fee-related details:

Trading fees at Tastyworks:

- Tastyworks charges 1 per contract U.S. Dollar for stock options.

- The platform charges 2.50 per contract U.S Dollar for options on futures. This fee is for the opening position, whereas the closing position on option is not charged.

- Tastyworks charges 1 25 per U.S. Dollars per contract to open and close of the futures investment.

- There is no commission charged on the stock trading by Tastyworks.

- There are no charges on the stock and ETF Commissions.

The financing rates: Tastyworks charges the financing rates or the margin rates in the case of trading on margin or short a stock. The charge is basically the rate of interest the trader pays for borrowing money or stocks from the trading platform.

Our Take:

After deeply inspecting all the key elements of the Trading platform- Tastyworks, we can confidently say that it is indeed a superb broker for options trading. When it comes to stock only trades, it gets a little complex. This U.S. based broker offers a very impressive investor protection scheme. Tastyworks, although a relatively new platform, is sure to attract many traders with its incredibly low trading fees, and free stock and average options trading fees. Not only this, but it also supports its clients with very beneficial educational and research-backed tools that help them in intelligent trading. If the clients have any issue about this platform, we solve their doubts through live chat and emails.

With all such tools and features, it can get quite daunting for the new beginners. For them, we would suggest practicing on demo accounts and then migrate to Tastyworks, because it is so worth it.

We felt a little improvement could go a long way in terms of deposit and withdrawal process, and offering a demo account on the platform may help Tastyworks to attract even the new beginner too towards itself. The fact that Tastyworks does not charge an inactivity fee, or a minimum deposit, or any kind of monthly fee, it can be a great way to attract more clients to the trading platform. All in all, we will give this fantastic trading platform a big thumbs up!