Key Highlights

- Treasury Secretary flip-flopped on Bitcoin purchases, first denying plans to buy more, then hinting at “budget-neutral” ways to expand its holdings

- The current US Strategic Bitcoin Reserve relies mostly on confiscated Bitcoins, avoiding taxpayers’ money

- The US government struggles with internal divisions, risking its claim as a “Bitcoin superpower”

The U.S. government’s approach to Bitcoin has become a rollercoaster of mixed emotions, leaving investors, economists, and even casual observers scratching their heads.

Bitcoin that has been finally forfeited to the federal government will be the foundation of the Strategic Bitcoin Reserve that President Trump established in his March Executive Order.

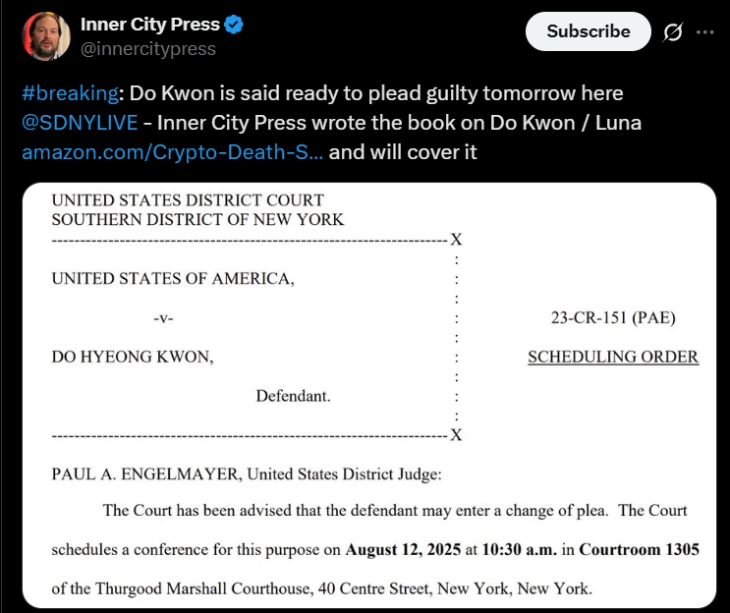

In addition, Treasury is committed to exploring budget-neutral pathways to acquire more…

— Treasury Secretary Scott Bessent (@SecScottBessent) August 14, 2025

On August 14, 2025, Treasury Secretary Scott Bessent made a huge statement, not once but twice. First, he declared that the federal government would not be buying more Bitcoin to expand its Strategic Bitcoin Reserve, a move that sent ripples through the crypto market.

Hours later, he backtracked, suggesting the Treasury might explore “budget-neutral pathways” to acquire more Bitcoin after all.

Scott said, “Bitcoin that has been finally forfeited to the federal government will be the foundation of the Strategic Bitcoin Reserve that President Trump established in his March Executive Order.”

This surprising reversal in a single day is not just bureaucratic noise, but it is a symptom of a deeper struggle within the U.S. government over how to handle cryptocurrency. Despite progressive regulatory developments, the US government’s wordplay around the Bitcoin reserve put the crypto sector in a dilemma.

A Reserve Built on Seizures, Not Purchases

When President Trump signed the executive order establishing the Strategic Bitcoin Reserve in March 2025, the plan had a controversial clause, which directed to consolidation of all Bitcoin seized from criminal cases (estimated at 200,000 BTC) and holding it as a long-term national asset, much like gold or oil reserves.

According to the executive order, No taxpayer money would be spent; the reserve would grow only through forfeitures.

This approach was proposed as fiscally responsible, avoiding market manipulation or political backlash. But almost immediately, cracks appeared in the strategy.

Behind the scenes, the administration was divided. Some officials, like White House crypto advisor Bo Hines, pushed for actively expanding the reserve, even suggesting selling some of the U.S. gold holdings to buy Bitcoin.

Others, including more cautious voices in the Treasury, resisted, wary of gambling public funds on a volatile asset. The result? A policy caught in limbo—officially committed to Bitcoin as a strategic asset but unwilling to put real money behind it.

The “Budget-Neutral” Loophole in Treasury

Bessent’s latest comments hint at a possible workaround. By emphasizing “budget-neutral” acquisitions, the Treasury could theoretically grow its Bitcoin stash without congressional approval or taxpayer expense.

How? One option: accepting Bitcoin as payment for federal debts or fines. Another: partnering with private firms to swap other assets for Bitcoin. But these ideas remain vague, and skeptics argue they are just fancy ways of avoiding a real commitment.

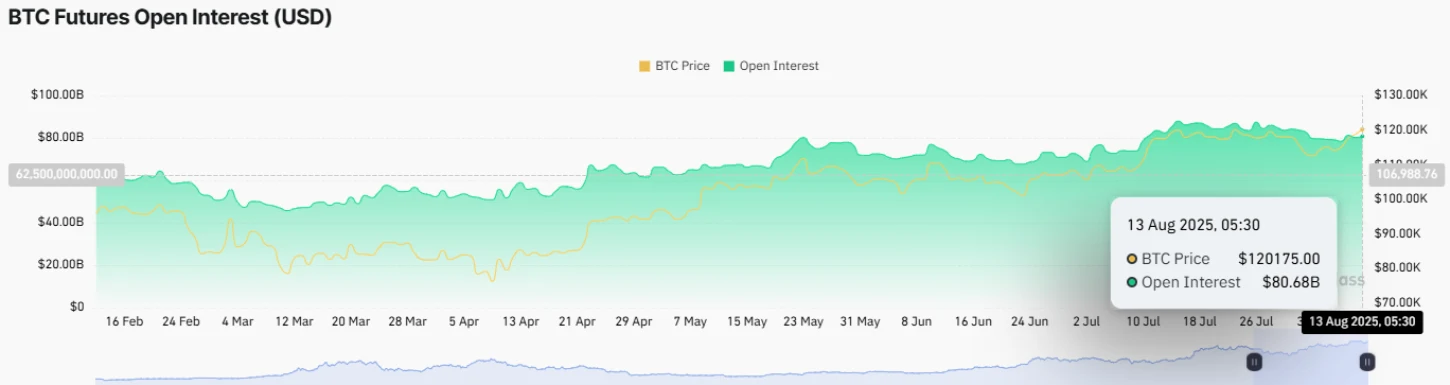

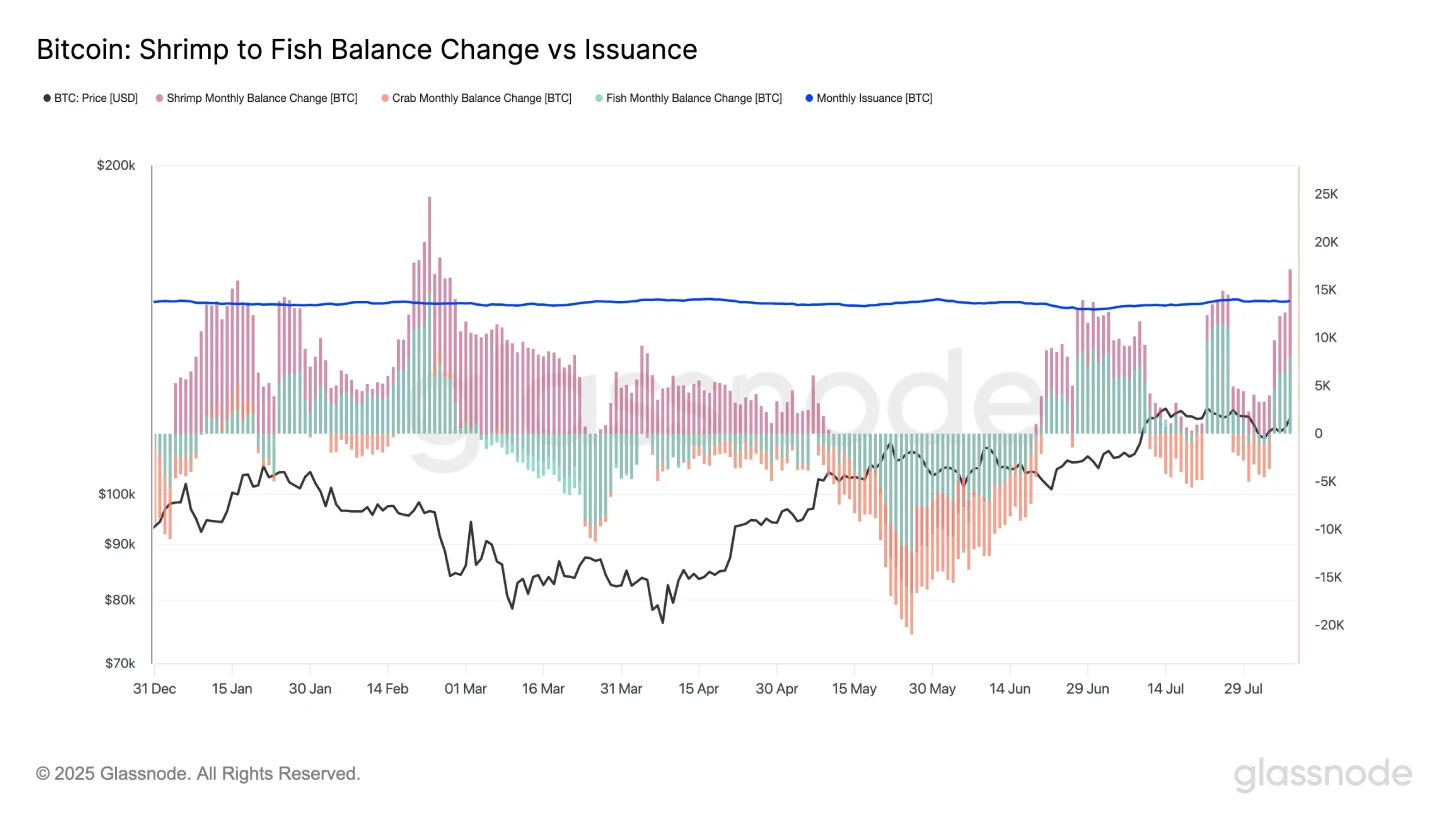

The ambiguity has real-world consequences. When Bessent initially ruled out purchases, Bitcoin’s price dipped. When he walked it back, the market perked up. This volatility underscores how much power the U.S. government now holds over crypto markets.

Symbolism vs. Substance

Critics argue the Strategic Bitcoin Reserve is more about politics than economics. Trump’s administration has leaned hard into pro-crypto rhetoric, hosting a “Digital Asset Summit” with industry leaders and rolling back regulations that stifled the sector.

But when it comes to putting federal dollars behind Bitcoin, the enthusiasm fades. The July 2025 White House report on digital assets, meant to outline a clear path forward, was conspicuously light on details about the reserve’s future.

Meanwhile, other countries aren’t waiting. China holds nearly 194,000 BTC, Bhutan has quietly amassed a stash worth 28% of its GDP, and even Iran uses Bitcoin to bypass sanctions. If the U.S. wants to be the “Bitcoin superpower” Trump envisions, it’ll need more than vague promises and seized coins—it’ll need a real strategy.

The Treasury’s next moves will define whether the Strategic Bitcoin Reserve is a landmark policy or a political stunt. If Bessent follows through on budget-neutral acquisitions, it could signal a new era of state-backed crypto adoption. If not, the reserve risks becoming a footnote in financial history, which could affect the Bitcoin price.