- Bitcoin price broke out from the key resistance of a flag pattern, signaling the continuation of the prevailing recovery.

- A multi-tiered demand pressure from BTC’s retail investors and large-scale investors could create a significant supply squeeze in the market.

- The BTC price is back above the fast-moving exponential moving averages of 20 and 50, indicating the near-term trend is strengthening.

The pioneer cryptocurrency, Bitcoin, takes a short dive of -0.46% during Friday’s U.S. market hours to currently trade at $116,970. Despite the intraday sell-off, the daily candle highlights a long-tailed rejecting candle, indicating an intact demand pressure in the market. This buying pressure can be attributed to multi-tiered demand from retail investors and crypto whales, notably outpacing new BTC issuance from miners. Is Bitcoin price poised to hit a new high in August?

Shrimp-to-Fish and Whales Unite in Aggressive Bitcoin Buying Spree

Since last weekend, the Bitcoin price has shown a brief rebound from $111,919 to the current trading value of $116,923, projecting a 5.13% surge. The buying pressure followed the regulatory developments in the United States as the president signed executive orders to allow crypto in 401(k)s and stop banking discrimination against digital assets.

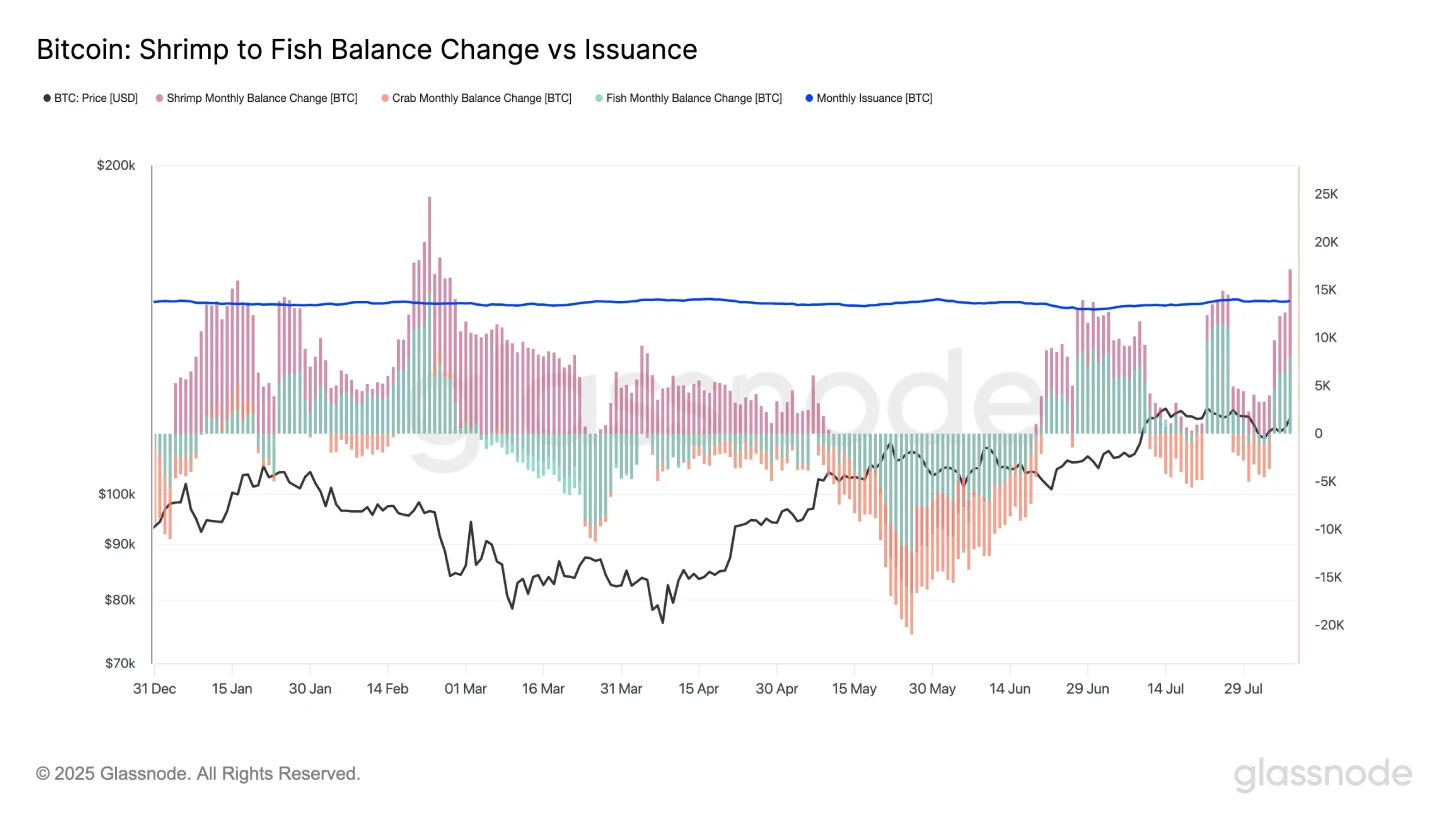

However, the coin price gained additional momentum as BTC’s small holders—dubbed as “Shrimp-to-Fish” cohorts or wallets with less than 100 BTC—are quietly absorbing the available supply at a pace that exceeds the new issuance.

According to the analytical platform Glassnode, these retail-driven addresses are maintaining a monthly balance growth of above 17,000 BTC, which is outpacing the +13.85K BTC created through mining.

Notably, the shrimps (wallets with less than 1 BTC) are adding nearly 10K BTC, underscoring a persistent demand from retail investors. Despite the recent price volatility, the retail conviction remains strong, and therefore, continued accumulation from these wallets could put upward pressure on the price over time.

Adding to the bullish note, the high-net-worth investors are also tightening their grip on the BTC supply. According to blockchain tracker Lookonchain, a newly created wallet, 175k5C, withdrew 100 BTC (worth approximately $11.71 million) from the Binance exchange just an hour before reporting.

While another whale, bc1qgf, received 263 BTC (worth $30.82 million) from FalconX to boost its current holding to 891.5 BTC worth $104 million.

This multi-layered demand from retailers and large-scale investors could create a significant supply squeeze in the market, bolstering the Bitcoin price for a higher rally.

BTC Price Teases Breakout from Bullish Flag Pattern

The daily chart analysis of the Bitcoin price shows its recent correction resonated within two downsloping trendlines of a bull flag pattern. The chart setup is commonly spotted in an established uptrend where its long ascending pole projects the dominant uptrend and a temporary pullback to regain bullish momentum.

On August 7, the BTC price gave a bullish breakout from the pattern resistance trendline, signalling the continuation of the prevailing recovery. With today’s downtick, the price shows a post-breakout pullback to the breached trendline, validating its suitability for a higher rally.

A long lower wick on Bitcoin’s daily candle highlights sustained demand pressure, signaling strong buyer support. This momentum could fuel a 5.63% rally, positioning BTC to retest its all-time high resistance at $123,233.

If the pattern holds true, the Bitcoin price could drive an extension towards the $137,000 mark.

However, if the retest candle enters the flag range, the sellers could try to regain their control over this asset for another correction push.

Also Read: XRP Surges as Ripple and SEC End Legal Battle with Joint Appeal Dismissal