- The Solana price rides a midterm recovery trend within a rising wedge pattern.

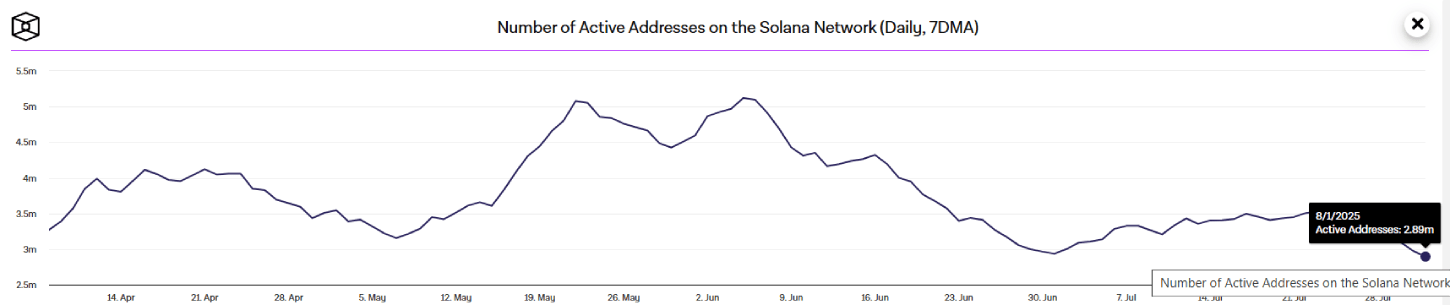

- The number of active addresses on the network has declined by 18% over two weeks, indicating a clear slowdown in user engagement.

- The SOL price breakdown below the 200-day EMA slope signals a potential 7% decline in the near future.

SOL, the native cryptocurrency of the Solana network, plunged over 3.87% during the U.S. market session and traded at $1.65. The bearish pullback has nearly evaporated the entire Monday market gain of this altcoin, signaling the continuation of the prevailing correction. The declining trend in the number of active addresses on the network and the open interest derivative market further reinforces the bearish momentum in price. Is the SOL coin heading below $150?

Solana Price Breaks Below Crucial $165 Support Amid User Activity Slump

In the past two weeks, the Solana price showcased a significant correction from $205.75 to the current trading price of $162.28, registering a 21.13% loss. Initially, the selling pressure came as a post-rally correction in the broader market but gained additional bearish momentum amid the notable decline in the number of active addresses on the SOL network.

According to TheBlock data, the active addresses on Solana have dived sharply from 3.53 million to 2.89 million, now registering an 18.1% loss.

This decline suggests a notable slowdown in user engagement and transaction throughput in the Solana network. The drop can be attributed to risk-off sentiment in the market, resulting in decreased DeFi activity. If the trend continues, Solana’s network momentum may face a short-term setback, potentially limiting its price recovery prospects.

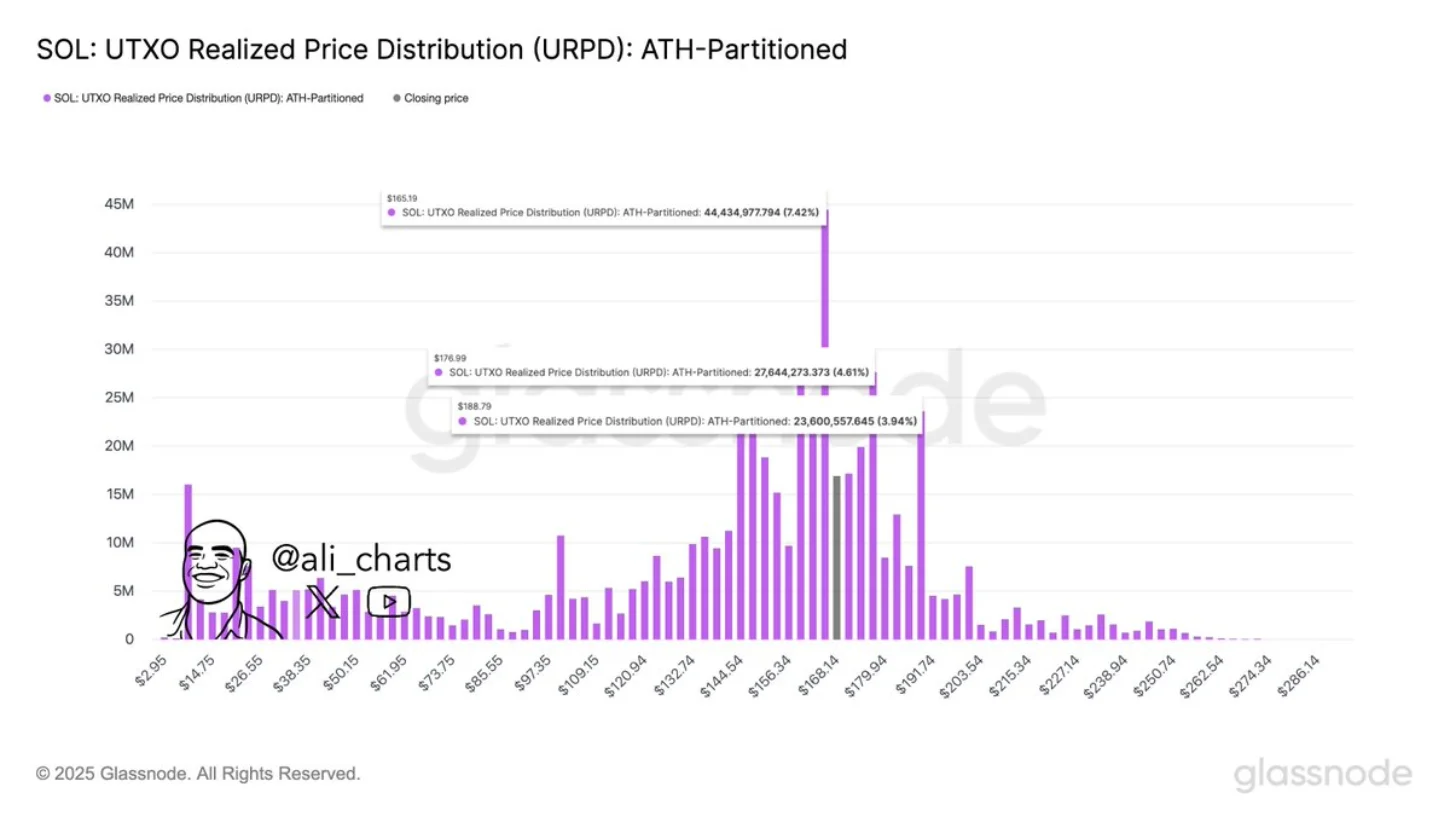

Additionally, a recent tweet from market analyst Ali Martinez highlighted that the $165 level stands as a crucial support level for Solana price with potential resistance levels at $177 and $189. According to the UTOX realized distribution data (URPD), over 44.4 million Solana tokens, i.e., 7.42% of the current supply, were acquired near the $165 level, marking its area of interest for traders.

However, with the intraday sell-off, the coin price breaks below the $165 support to currently peak at the $162 mark. This bearish breakdown flips a strong demand zone into a potential resistance, reinforcing the risk of further correction.

As the market uncertainty persists, a potential uptick to $165 could allow the mass volume of holders to sell their coins at breakeven, notably accelerating the market selling pressure.

Also Read: Bitcoin Demand Remains Resilient Amid Price Volatility; $125K BTC Soon?

SOL Drive Prolonged Correction With Wedge Pattern

The daily chart analysis of Solana price shows a V-top reversal from the resistance trend line of a rising wedge pattern. Since March 2025, the coin price has been resonating between the two converging trendlines of the pattern as it drives a steady mid-term uptrend in price.

Currently, the falling SOL price teases a breakdown below the 200-day Exponential Moving Average— a level that offers a general sentiment in the market for an asset.

If the breakdown sustains, the sellers could push another 7% drop to hit the pattern’s lower boundary at the $150 mark.

Having said that, the bottom support trendline has acted as a strong accumulation zone for buyers to recoup the bullish momentum. Historically, a reversal from this support has bolstered a recovery trend, offering a growth within a range of 63% to 97%.

Until the price breaks below the lower trendline of the wedge pattern, the coin price could hold its broader bullish trend.

Also Read: MetaMask, Stripe Prepares to Launch Stablecoin “mmUSD”