- The Ethena price correction resonating within the flag pattern could drive a temporary pullback in the near term with potential breakout loading.

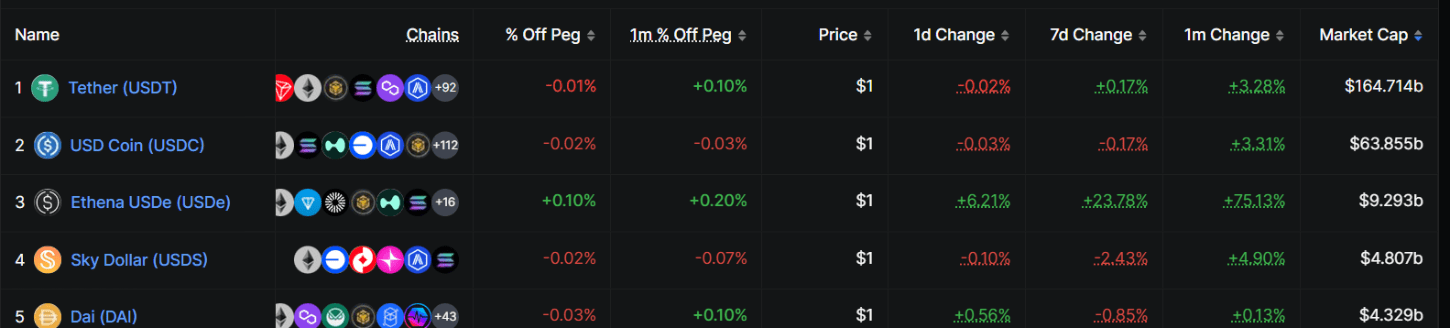

- Since last month, Ethena’s USDe supply has bounced 75% to reach $9.29 billion, becoming the third-largest stablecoin by market cap.

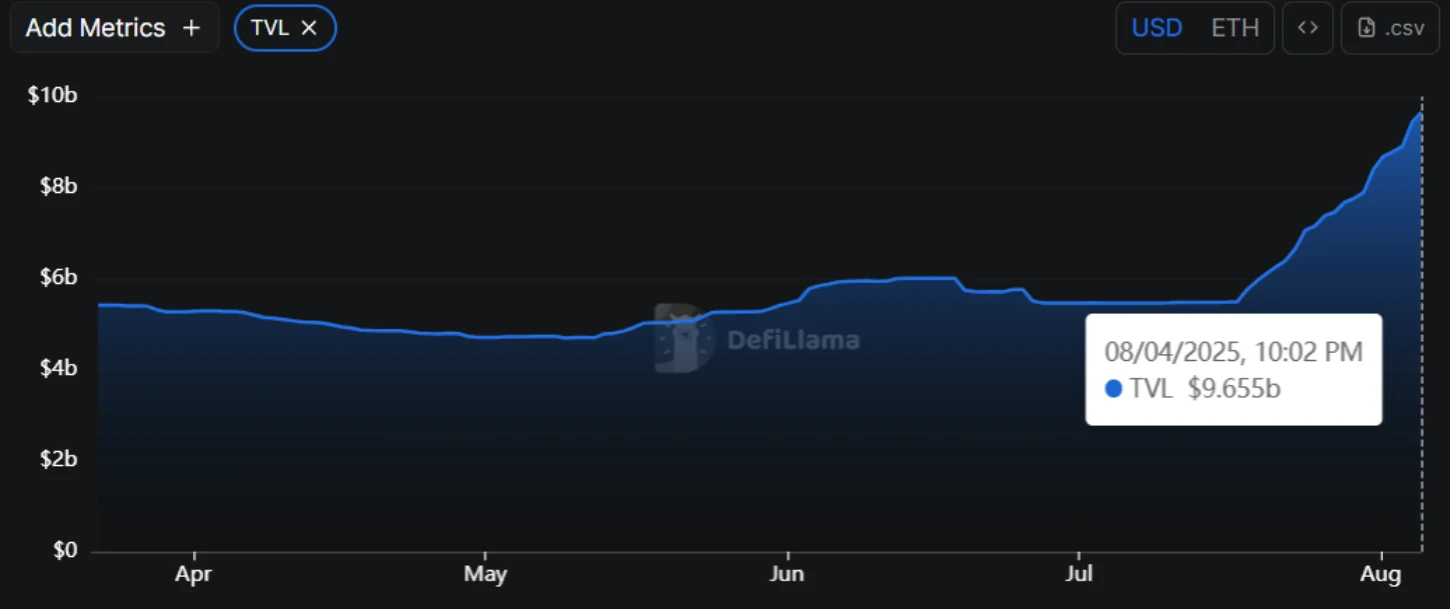

- Since mid-July, the total volume locked (TVL) on ENA bounced from $5.48 billion to $9.65 billion, accounting for 75% growth.

ENA, the cryptocurrency of the synthetic dollar protocol Ethena, shows a slight uptick of 2.5% on Monday, August 5th. The intraday buying pressure aligns with the broader market relief rally after a significant correction last week. If the upswing manages to overcome the prevailing selling pressure, the enterprise could resume its downtrend and challenge a breakdown below $0.5. However, the on-chain data highlights a significant supply growth in USDe, indicating rising investor confidence in Ethena’s ecosystem and a strong capital inflow. Will fundamental growth push ENA to a $1 rally?

Ethena Price Correction Deepens as On-Chain Data Signals Continued Selling Risk

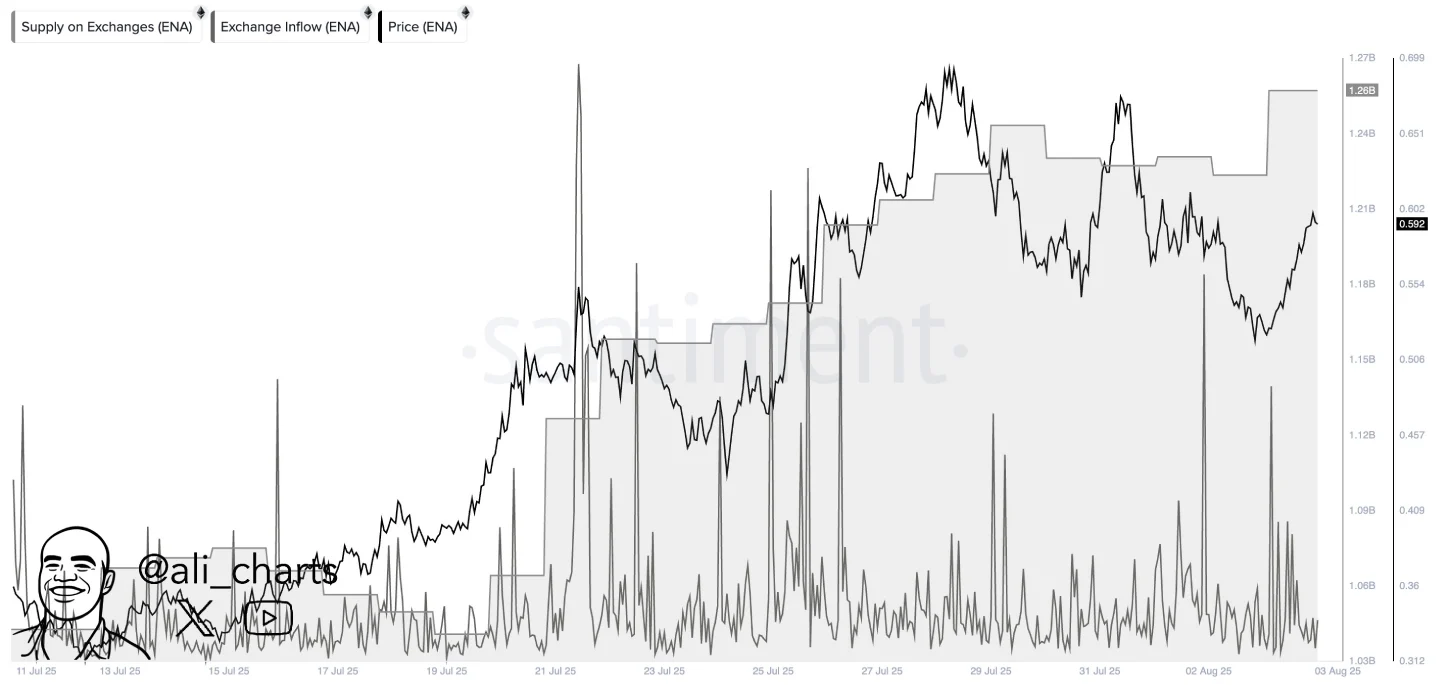

Over the past week, the Ethena price has shown a brief correction from $0.7 to the recent correction low of $0.51, accounting for a 27% loss. While the downswing followed a broader market pullback, the recent on-chain data reveal a notable increase in ENA exchange inflows, signaling the risk of a prolonged correction.

In a recent tweet, market analyst Ali Martinez highlighted that over 250 million ETH has been sent to exchanges in the last two weeks. A surge in ENA transfer to exchange implies rising selling pressure as investors may be preparing to offload holdings amid the market uncertainty.

The four-hour chart analysis of ENA price shows the current correction resonating within the formation of a bull-flag pattern. The chart setup is characterized by a long ascending pole reflecting the dominating trend in the market, followed by a temporary pullback within two downsloping parallel trendlines.

Currently trading at $0.6, the coin price is just 6.8% short of challenging the flag’s resistance at $0.64. A potential breakout from this resistance will accelerate the buying pressure and push ENA to a $0.7 rally.

However, if the supply pressure at the dynamic resistance persists, the coin price will drive another bearish swing within the pattern and challenge a bearish move below the $0.5 psychological support.

Also Read: Bitcoin Demand Remains Resilient Amid Price Volatility; $125K BTC Soon?

ENA Poised For Breakout From Cup And Handle Pattern

Despite the anticipated price correction, Ethena’s synthetic dollar stablecoin, USDe, has recorded a staggering 75% surge in supply over the past month, according to DeFiLlama data. The supply has now reached $9.29 billion, pushing USDe above Sky Follow (USDS) to become the third-largest stablecoin by market cap.

Simultaneously, Ethena has been steadily climbing the DeFi ladder to become the sixth-largest protocol by total volume locked (TVL), accentuating the growing user confidence and capital influx into the platform.

The sharp rise in supply and TVL indicates a substantial capital rotation among Ethena’s ecosystem, with yield-hungry DeFi natives and risk-conscious stakers being drawn to the protocol.

The daily chart analysis of ENA price shows that the recent pullbacks within flag patterns could bolster buyers to complete a cup-and-handle reversal pattern. The chart setup is characterized by a long-accumulation trend with a U-shaped recovery followed by a temporary pullback to recuperate the exhausted bullish momentum.

Thus, a potential breakout from the $0.7 neckline will signal a major change in market dynamics. The post-breakout rally could push the price over 64% to hit the initial target of $1.15.

Also Read: CFTC Introduces Spot Crypto Trading Under Federal Oversight