- Ethereum price recovery is poised to challenge a key resistance level at $3,740 amidst the formation of a flag pattern.

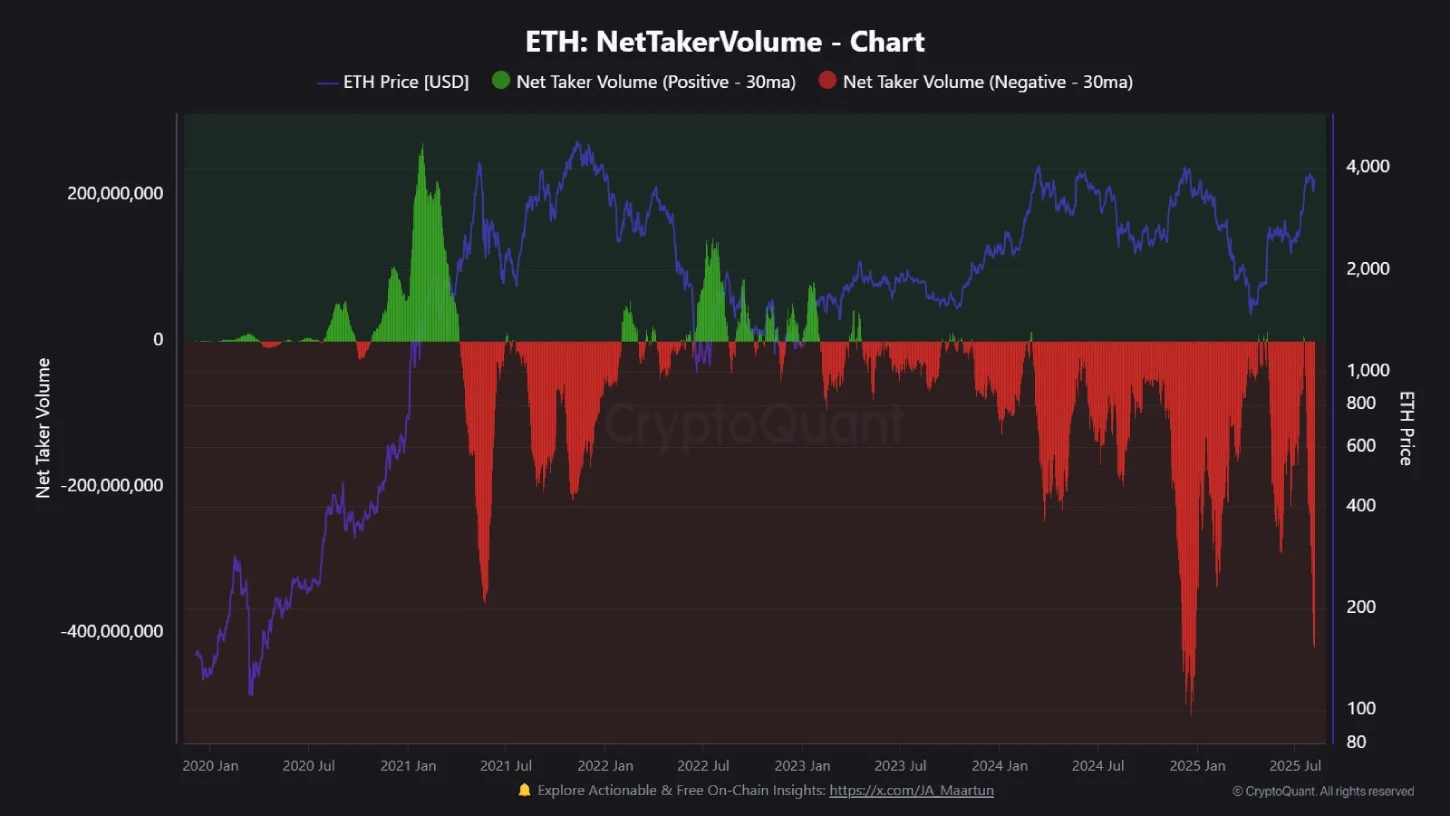

- ETH’s net taker volume plunged into the negative region, indicating the aggressive selling pressure in the market.

- Lookonchain data reveals that whale crypto wallets have transferred a million dollars’ worth of Ethereum to crypto exchanges.

ETH, the native cryptocurrency of the smart contract giant Ethereum, records a 1.75% jump during the U.S. market hours. With the intraday surge, the Ethereum price is likely to challenge a key resistance zone at $3,740, signaling a pivot level for the asset to determine its next move. However, the on-chain data highlights that whales and retail traders are rushing to exit the market, reinforcing the selling pressure in price. Is a breakdown below $3,500 looming?

Negative Net Taker Volume and Whale Selling Suggest Deeper ETH Correction

In the last two weeks, the Ethereum price has shown a brief correction from $3,940 to the current trading price of $3,684, projecting a 6.5% loss. The pullback initiated with broader market sentiment for a post-rally correction, but bears gained additional momentum amid the aggressive selling pressure from market participants.

In a recent post, market analyst Maartunn highlighted that ETH’s net taker volume has dived deep into negative territory, currently sitting at -$418.8 million. This metric highlights the disparity between aggressive buyers and sellers in the market, who prefer quick market orders over waiting for limit orders.

When net taker volume skews negative, it indicates that sellers are currently the aggressive force in markets, typically a precursor for a a potential downturn. According to CryptoQuant data, the taker sellers have offloaded 104.3k more ETH coins than the buyers are willing to absorb.

The sharp disparity suggests that the participants are prioritizing the speed of execution over the suitable price exit, subtly resembling panic selling. If the trend persists, Ethereum’s short-term outlook would continue to remain under pressure as sellers’ influence dominates.

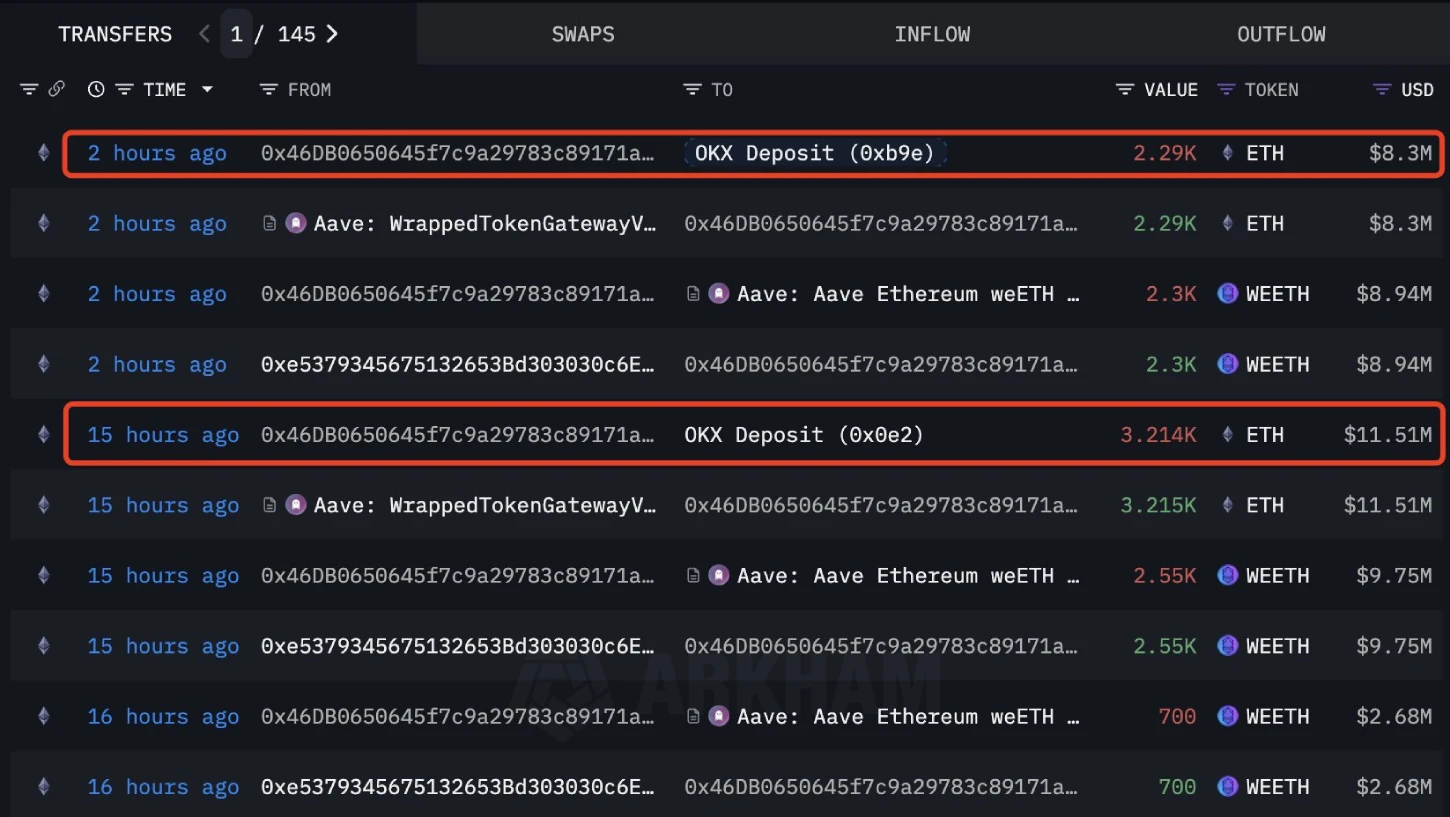

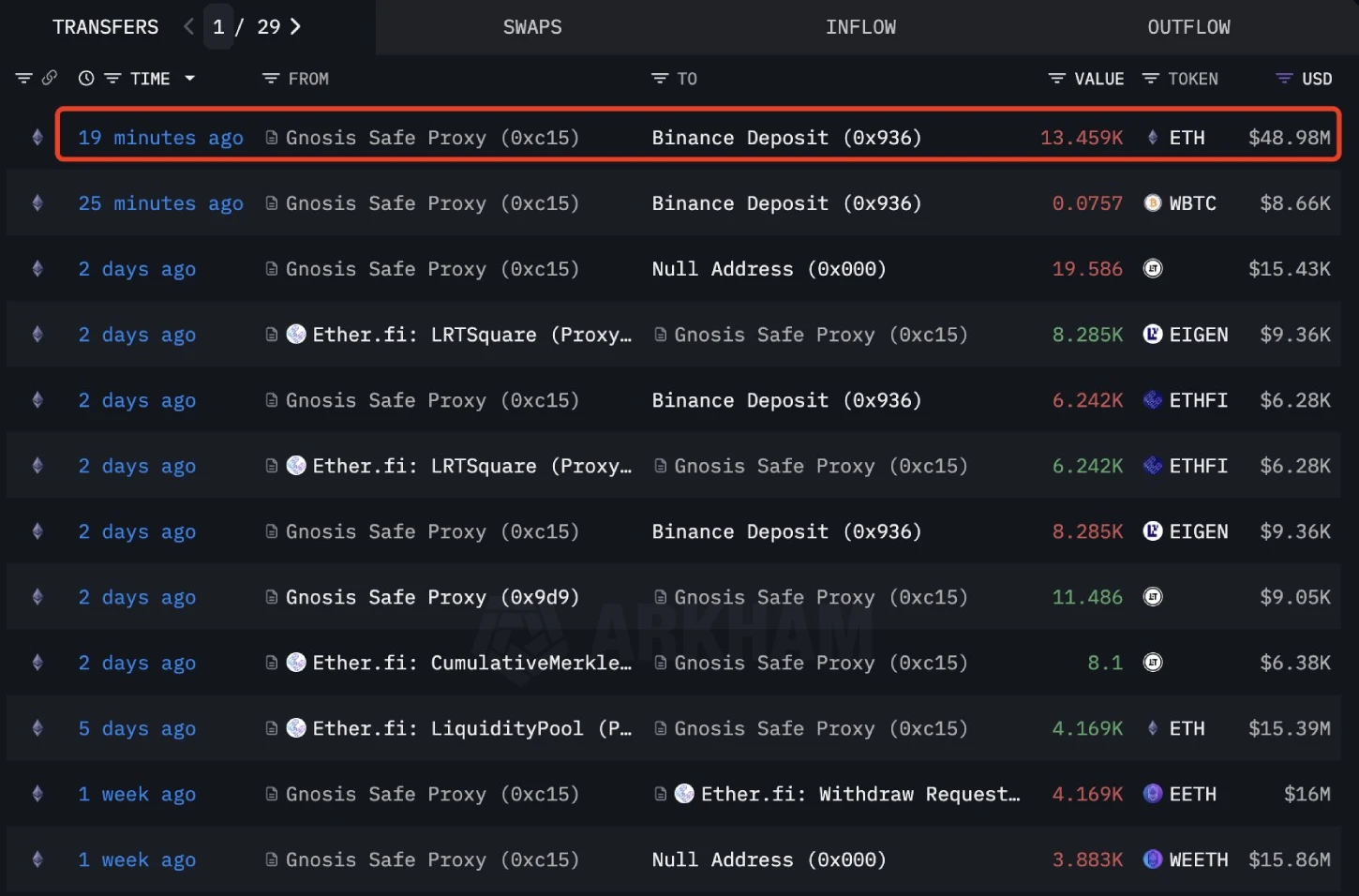

Adding to the bearish note, the blockchain tracker LookonChain reveals a notable selling pressure from high-net-worth investors in today’s market.

Earlier today, a crypto whale wallet, 0x46DB, deposited 5,504 ETH, valued at around $19.89 million, to the OKX exchange.

In addition, another wallet, 0xc156, deposited 13,459 ETH (worth approximately $49 million) to the Binance exchange just 20 minutes before reporting.

Historically, a distribution phase from crypto whales has often been accompanied by a major market correction and continues to correct in price.

Also Read: MetaMask, Stripe Prepares to Launch Stablecoin “mmUSD”

Ethereum Price Stands at a Pivot Level of a Flag Pattern

The ongoing correction trend in Ethereum price has found a temporary bottom at the $3,365 level before driving a sharp reversal. The bullish upswing pushed 9.3% up in the last 4 days to currently trade at $3,673. If the renewed recovery persists, the buyers could challenge a key confluence of horizontal resistance level and downsloping trendline of the flag pattern at $3,740.

A potential breakout below this barrier would accelerate the market momentum and boost the price for an initial surge towards $4,150.

On the contrary, the current market uncertainty and mounting selling pressure from whales and retail traders signal the risk of a potential reversal. If the coin price displays a renewed selling pressure at $3,740, the sellers could push for a prolonged downtrend below $3,537 and $3,365 support.

Also Read: Solana Price Signals 7% More Pain as Bulls Lose Control of Key Support