- BTC’s dominance has dived to 59%, signaling a growing interest in alternate cryptocurrencies and potentially the start of an “altcoin season.”

- A brief decline in futures open interest shows the coin price could struggle to drive a high-momentum rally in the short-term trend.

- The formation of a rising wedge pattern signals a potential correction looming for Bitcoin price.

The pioneer cryptocurrency Bitcoin shows a notable uptick of 2.4% during Wednesday’s U.S. market hours to trade at $122,989. The broader bullish sentiment and September rate cut hopes are fueling this rally, with the coin price just 1.5% short of a new high. However, the technical chart shows intense overhead supply around $122,000 with a bearish pattern signalling risk for a potential pullback. Additionally, the on-chain data highlights a declining trend in Bitcoin’s dominance, suggesting a capital rotation to altcoins. Will the Bitcoin price rally lag behind?

BTC Dominance Drops to 59% Amid Altcoin Rally

In the last two weeks, the Bitcoin price showed a V-shaped recovery from $111,987 to $122,989, projecting a 9.8% growth. Subsequently, the asset market cap bounced to $2.44 trillion. The buying pressure gained momentum from the notable surge in spot BTC ETF, growing institutional adoption, and regulatory development in the U.S., including the cryptocurrency investments in 401(k) retirement accounts.

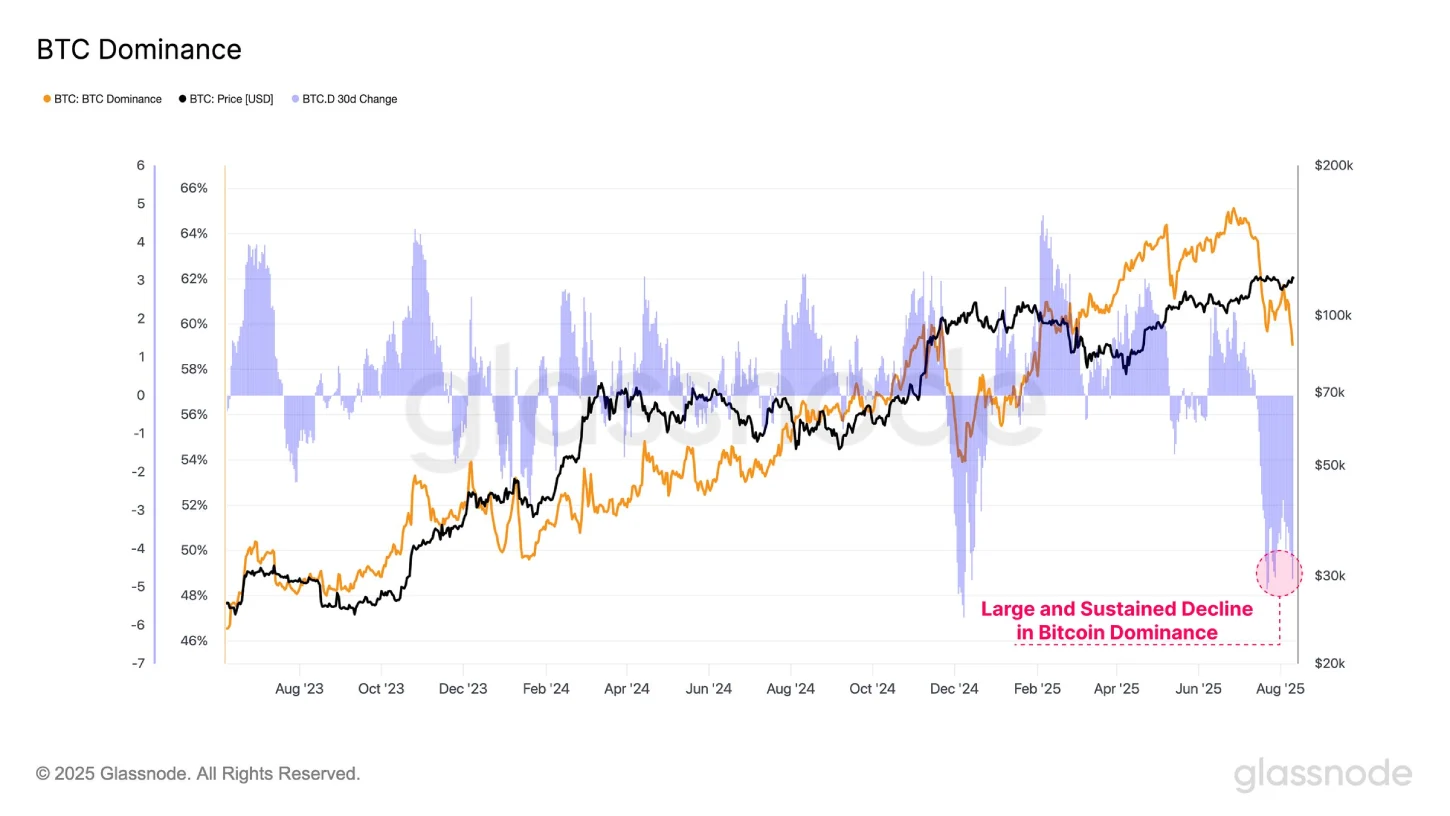

Despite this upswing, the altcoin market has significantly outperformed Bitcoin since last week, spearheaded by the Ethereum price rally. According to Glassnode data, Bitcoin’s dominance has experienced a notable decline from 65% to 59% in the last two months.

This marks one of the steepest drops in BTC dominance this year amid large capital rotation to alternative cryptocurrencies. Historically, a significant drop in Bitcoin dominance boosts an altcoin season.

The altcoin season index is now pushing towards 75%, signalling a broader-based shift in investors’ sentiment as market participants adopt a risk-on behavior to chase higher returns.

That said, a decline in Bitcoin dominance is less likely to cause selling pressure on its price. However, if the trend persists, BTC’s price recovery could struggle to gain strong momentum and lag behind the altcoins.

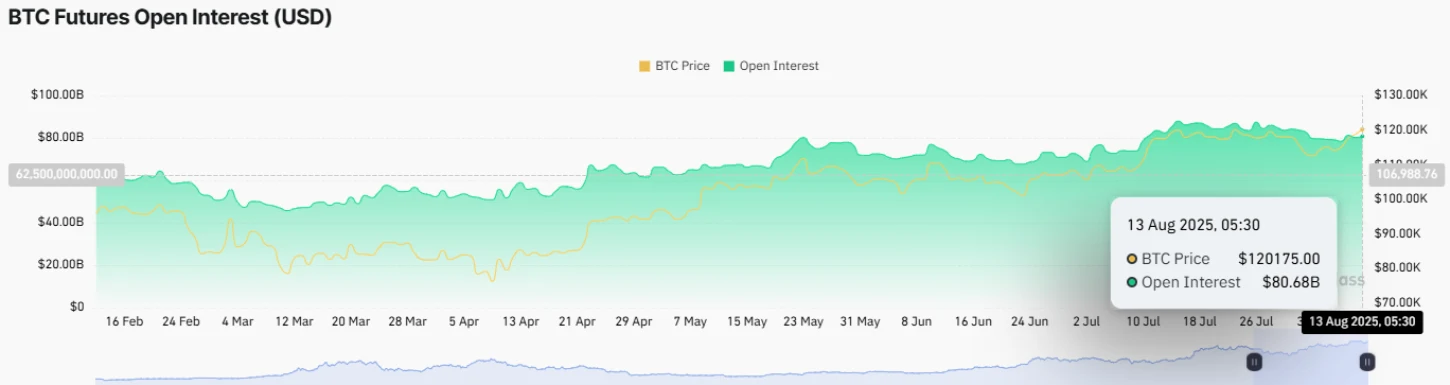

In addition, the derivative market data shows a waning interest from futures traders as the open interest (OI) value shows a brief decline despite a price jump. According to Coinglass data, the BTC’s OI slope has dropped from $87.3 billion to $80.68 billion in the last three weeks, accounting for a 7.6% drop.

This decline indicates that traders are exiting their existing positions in the futures market or hesitating to enter a new trade. The lack of inflow from speculators could slow down recovery momentum in BTC.

Bitcoin Price Drives Steady Recovery With Wedge Pattern

With a 2.4% intraday gain, Bitcoin’s daily chart shows a strong green candle ready to knock the all-time high resistance. If today’s candle closes at the current price of $122,989, a new high is likely to occur tomorrow if not today.

A potential breakout will accelerate the bullish momentum and drive the coin price another 7% to hit $132,767. This horizontal level currently coincides closely with a traditional pivot level (R2), the resistance trendline of the rising wedge pattern, creating the next significant supply zone against crypto buyers.

The price jump will also push the momentum indicator RSI (Relative Strength Index) to overbought, increasing the risk of a post-rally correction. A history of this pattern shows that a bearish reversal within it has often led to sustained correction towards the bottom trendline.

So far, these corrections have bolstered Bitcoin price to renewed recovery momentum. However, a breakdown below the bottom support will accelerate the selling pressure for a prolonged downfall.

Also Read: BitMine Expands Stock Sale to $24.5B for ETH Buys