- The Ethereum price shows a decisive breakout from the symmetrical triangle pattern, ending a 48-month accumulation trend.

- On August 11, 2025, the ETH spot ETF recorded a massive inflow of over $1.018 billion, signaling strong demand pressure in Ethereum

- BitMine, an Ethereum treasury company, announced a significant increase in the total amount of common stock it plans to sell, raising the cap to $24.5 billion.

ETH, the native cryptocurrency of the smart contract giant Ethereum, witnessed a sharp jump of 6.14% to currently trade at $4,445. Simultaneously, ETH’s market cap bounced to $536.54 billion, while the 24-hour trading volume is up 16% to waver at $49.04 billion. With the intraday surge, the coin is just 9% short of hitting its all-time high mark at $4,891.70.

Given below are three key reasons why the Ethereum price is up today. Will this recovery continue?

ETH Demand Surged with $1.02 Billion in Spot ETF Inflows

In the past two months, the Ethereum price showcased a high momentum rally from $2,115 to the current trading value of $4,487, registering a 112% growth. A significant contributor to this rally is the aggressive inflow from Spot Ether exchange-traded funds (ETFs).

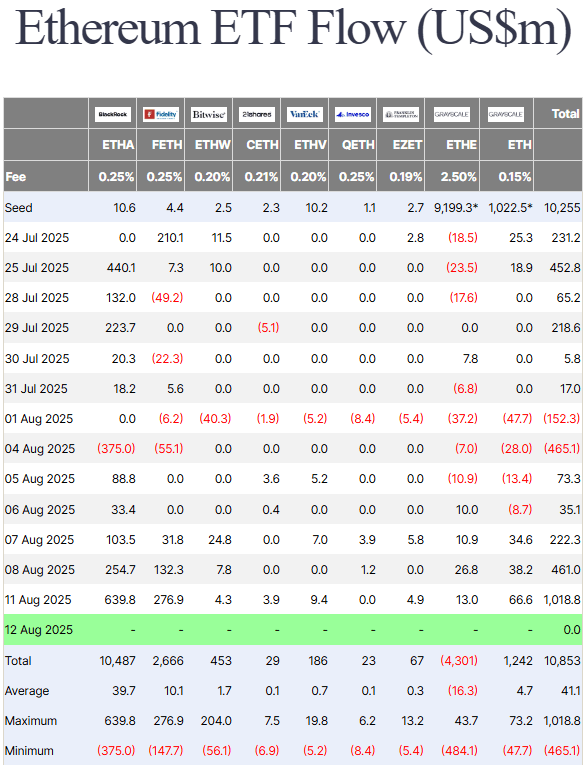

On August 11, 2025, the U.S.-based spot ETH ETF recorded their biggest day of net inflows, with flows across all funds together totaling around $1.018 billion.

According to Farside Investors, BlackRock’s iShares Ethereum Trust ETF (ETHA) attracted the lion’s share of $639.79 million. Fidelity Ethereum Fund (FETH) was the runner-up, recording a substantial inflow of $276.9 million.

Ethereum enthusiast Anthony Sassano posted on Tuesday that spot Ethereum ETFs have bought over 50% of all the net issued ETH since the Merge in late 2022.

The blockchain has issued over 451,079 ETH since its switch to proof-of-stake, while the ETH ETFs during Monday’s trading saw a total inflow of over 238,200 ETH.

This demand scarcity significantly bolsters the ETH price for a sustained recovery.

Also Read: Bitcoin Soars Above $121,000 after Dipping Below $113,000

Institutional Support for Ethereum Grows as BitMine Raises $24.5 Billion Sales Cap

Another factor bolstering the recovery trendline in the ETH price is the institutional adoption. Just recently, the Ethereum treasury company, BitMine, announced a major update in its latest supplementary prospectus.

The firm revealed that they are significantly increasing the total amount of common stock that it plans to sell under its existing Sales Agreement, raising the cap to $24.5 billion. The revised figures include $2.0 billion under the initial prospectus and $2.5 billion under the prior prospectus supplement. Moreover, BitMine is looking to add an additional $20.0 billion under the latest Prospectus Supplement.

The update signals strong confidence in ETH’s growth potential from institutional players.

According to Coingecko data, BitMine currently holds 1,150,263 ETH (valued at $5.17 billion) at an average price of $3,644.

Ethereum Price Exits a 48-Month Accumulation Trend

On August 8, 2025, the Ethereum price recovery provided a major breakout from the upper boundary of the symmetrical candle pattern. Since November 2021, the Ethereum price has been actively resonating within the two converging trendlines of this pattern, driving a major accumulation zone for buyers.

With the recent breakout, the coin signals the increasing dominance of buyers and potential for a continued price recovery. A sharp upward incline in the daily exponential moving average (20, 50, 100, and 200) reinforces the bullish sentiment in the market.

With sustained buying, the ETH price is likely to jump over 8.3% and challenge the all-time high resistance of $4,875.

However, if the pattern holds true, the coin could drive an extended recovery triangle target of $7,330.

Also Read: SUI Price Risks 16% Drop if 200-day EMA Support Fails