Key Highlights

- Do Kwon is expected to change his plea, possibly admitting guilt at his Manhattan hearing

- The court order suggests a possible plea deal, which will help them accelerate the resolution and avoid a trial originally set for January 2026

- Kwon has already been hit with a $4.5 billion SEC penalty

Do Kwon, the 33-year-old South Korean entrepreneur once celebrated as a crypto mogul, is expected to plead guilty in one of the biggest fraud cases in digital currency history. The hearing could be the final act in a saga that saw the spectacular implosion of two cryptocurrencies, TerraUSD and Luna, wiping out around $40 billion in value and shaking global confidence in the entire sector.

(Source: Inner City Press on X)

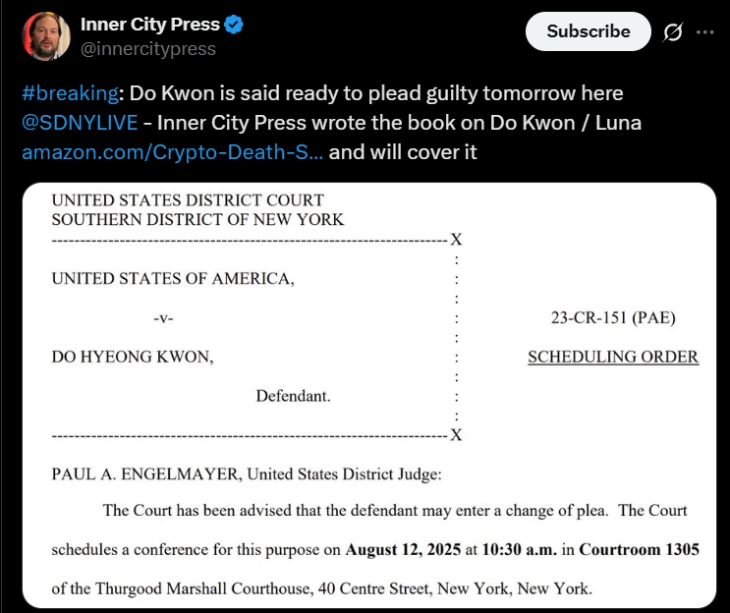

Court filings on Monday revealed that Do Kwon, co-founder of Singapore-based Terraform Labs, may change his plea at a hearing set for Tuesday morning in Manhattan federal court.

This is a major shift until now, as he had insisted on Do Kwon’s innocence against a sweeping list of charges, including securities fraud, wire fraud, commodities fraud, and money laundering conspiracy.

The update, first reported by Bloomberg, came in the form of a short order from the U.S. District Judge Paul Engelmayer, who noted he had been told that Do Kwon might alter his plea.

The hearing, scheduled for 10:30 a.m. EDT, could see Kwon outline his role in the 2022 crash that erased fortunes and left thousands of investors, from retail traders to big funds, counting their losses.

Do Kwon’s Journey: Crypto Star to Lawbreaker

Kwon’s rise in the crypto world was meteoric. Through Terraform Labs, he launched TerraUSD, a so-called algorithmic stablecoin meant to stay pegged to the U.S. dollar without traditional reserves like cash or bonds. Instead, it relied on a complex system linked to its sister token, Luna, to maintain stability.

For a time, it worked, and Kwon became a star. Investors saw TerraUSD as a breakthrough in decentralized finance, and Luna’s value soared. But in May 2022, the algorithm failed. TerraUSD slipped from its $1 peg, triggering a death spiral for Luna. Within days, Luna’s price plunged to near zero.

The crash was catastrophic. Estimates suggest it vaporized $40 billion in market value. For ordinary investors, some of whom had sunk life savings into the tokens, the losses were devastating. The event also rippled across the broader crypto market, dragging down other projects and fueling calls for tougher regulation.

Flight, Arrest, and Extradition

After the collapse, Do Kwon’s image shifted from crypto visionary to fugitive. South Korean authorities issued a warrant for his arrest, accusing him of violating capital market laws. In March 2023, he was detained in Montenegro, caught trying to board a flight with forged travel documents.

What followed was a months-long legal tug-of-war between the U.S. and South Korea over where he should face trial. Montenegro ultimately sent him to the U.S. in late 2024.

Since then, Kwon has been held in custody, staring down a nine-count criminal indictment. Prosecutors allege he misled investors and manipulated markets to artificially prop up TerraUSD and Luna.

Tuesday’s hearing could determine whether Kwon admits guilt outright or negotiates a plea deal to reduce potential prison time. Judge Engelmayer’s order made it clear that Kwon’s legal team had been instructed to review any agreement with him beforehand.

Originally, a trial was scheduled for January 2026. Prosecutors were preparing to present six terabytes of evidence, a mountain of data that could have stretched proceedings for months. A guilty plea would short-circuit that process, delivering a swifter resolution.

This criminal case follows a civil blow earlier in 2025, when the U.S. Securities and Exchange Commission (SEC) won a $4.5 billion judgment against Kwon and Terraform Labs.

The SEC accused Do Kwon of falsely promoting TerraUSD as a reliable, safe investment while being aware of its fragile design. That case carried no prison time, but the criminal charges do.

The collapse of TerraUSD and Luna remains a cautionary tale. Unlike traditional currencies, cryptocurrencies depend on technology and investor trust rather than government backing. When the system underpinning TerraUSD faltered, it didn’t just sink Luna; it sent shockwaves through the entire market.

For small investors, it was like watching a trusted bridge crumble overnight. Many had believed Kwon’s assurances that TerraUSD was safe, only to find themselves holding tokens worth a fraction of what they paid.

On X (formerly Twitter), reactions to the news of a possible guilty plea have been mixed. Some see it as long-overdue accountability, while others remain bitter, knowing no verdict will restore the billions lost.