- Bitcoin’s 30-day active supply in decline shows a slowdown in market activity to build the next major move.

- The Bitcoin price drives a short consolidation trend between the $123,236 and $111,999 horizontal levels.

- BTC’s fear and greed index dropped to 60%, indicating a greed sentiment among market participants for higher recovery.

The renewed recovery in Bitcoin price took a short pullback on Saturday, August 23rd, where it dropped over 1.5% to trade at $115,273. However, this selling pressure backed by weak volume indicates a lack of conviction from sellers and higher potential for bullish continuation. The recent slowdown in BTC’s supply movement further accentuates that the market is shaping up for the next big move. Will the top cryptocurrency climb towards $130,000, or is a major correction looming?

Supply Movement Cools Off as Bitcoin Prepares for Next Major Move

Last Friday, the Bitcoin price showcased a sharp rebound from $111,919 weekly support with nearly a 4% gain. A primary catalyst behind this jump was Federal Reserve Chair Jerome Powell’s remarks at Jackson Hole, where he hinted at potential interest rate cuts amid shifting economic risks.

Despite Powell’s cautious tone, the market optimism bolstered a majority of major cryptocurrencies for a sharp rebound. However, the recovery took a slowdown on Saturday, and BTC plunged to $115,273 with a 20% fall in trading volume. The lower volume during the pullback suggests reduced selling pressure, leaving room for a potential recovery if buyer participation strengthens.

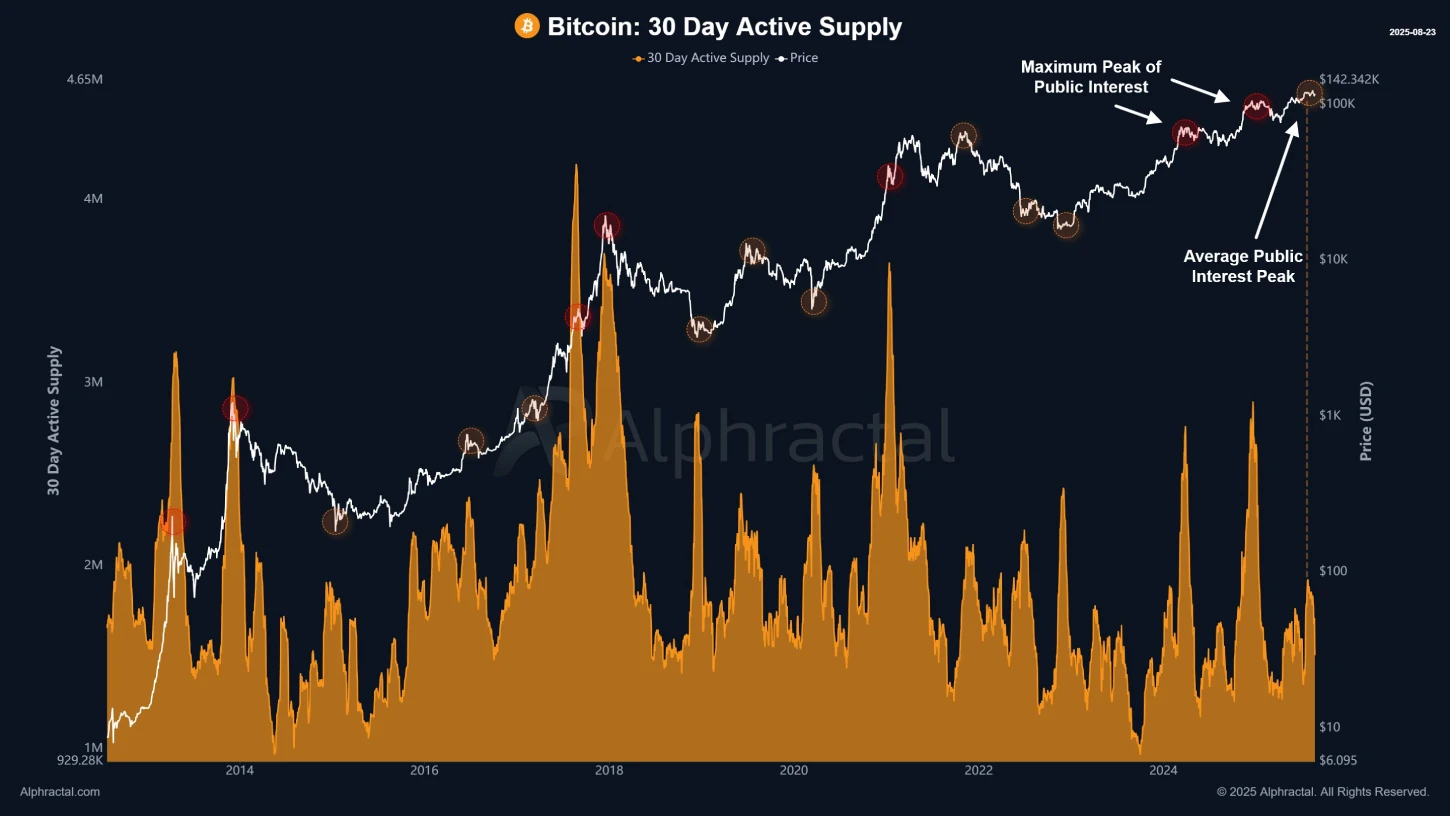

Low volume often allows buyers to build bullish momentum for the next leap. The latest on-chain data on Bitcoin’s 30-day active supply supports this bullish narrative. This metric tracks the number of unique coins moved in the past month, acting as a thermometer of market interest in BTC.

A rising trend in this metric suggests fresh capital inflow and stronger investor activity. Historically, these spikes have aligned with market tops and bottoms, as greed or fear often drives investors to move coins rapidly.

On the other hand, a declining trend in BTC’s 30-day active supply shows a quieter phase, with fewer coins in motion. Such a cooldown typically follows periods of extreme activity.

At present, Bitcoin’s supply movement has slowed down, suggesting a clearer backdrop after a recent surge in market enthusiasm. This moderation could provide the Bitcoin price a short breather to build its momentum for its next major move.

Bitcoin Price Enters Post-Rally Consolidation

The short-term trend analysis of the Bitcoin price shows a sideways shift to its prevailing recovery phase. Over the past six weeks, the coin price has reversed twice from the overhead resistance of $123,236 and bounced twice from the newfound support of $111,999, indicating a consolidation trend in action.

Following the July rally, this lateral trend could allow buyers to recuperate the exhausted bullish momentum before the next breakout. The coin price trading above the daily exponential moving average (20, 50, 100, and 200) accentuates the broader market sentiment.

Currently, the coin buyers are struggling to breach the midline resistance of this consolidation trend at $117,838. If the buyers flip this resistance to support, an accelerated bullish momentum could push BTC price against all-time high resistance at $123,236.

A potential breakout with a daily candle closing will signal the continuation of the prevailing uptrend, with the traditional pivot level indicating the next key resistance at $138,820.

On the contrary, if the sellers force a breakdown below the $111,900 support, the coin price could enter a deeper correction towards the $105,357 mark.